212 results found

Nicholas Yandle, Head of Programmes - Project Futures, UK IPA shares insights on their recent Roadmap, exploring ways to achieve digitalisation, standardised approaches and carbon emissions reductions when it comes to infrastructure delivery.

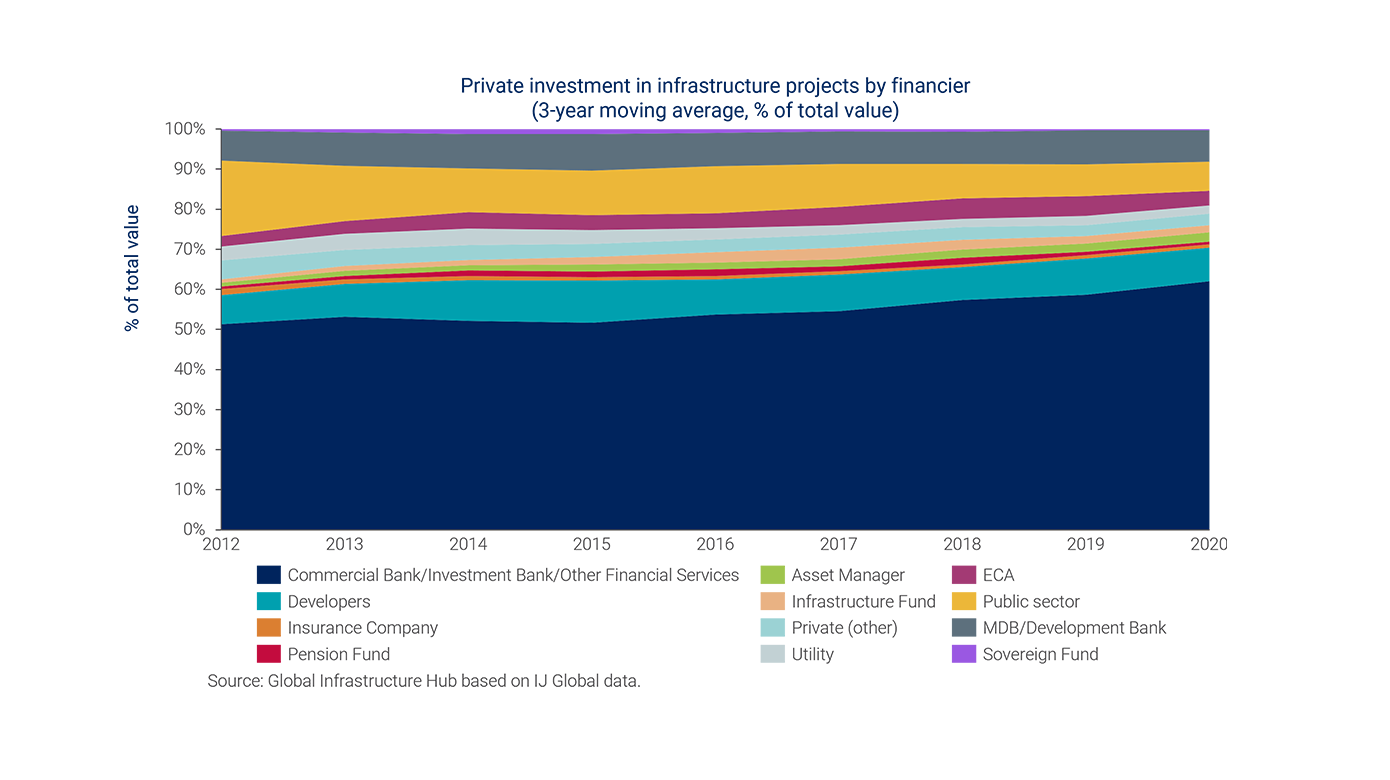

The GI Hub recently hosted a webinar that provided participants with a data-informed understanding of the state of infrastructure investment. In this article we present the main takeaways from the event.

Open data is another aspect of digitalisation that is gaining traction. This blog explores the importance of open data to infrastructure delivery and offers some practical steps for decisionmakers in the public and private sector to implement and utilise open data.

The COVID-19 pandemic boosted investors’ interest in digital infrastructure and digital services. Policymakers have an opportunity to amplify these effects by accelerating market reforms

Integrating ESG into infrastructure decisions requires a systematic and verifiable governance (implementation) approach of a projects ability to reduce environmental and social risk alongside long-term value for investors

The GI Hub began examining the regulatory capital treatment of infrastructure investments in 2019, as part of our initiative to address barriers to the establishment and advancement of infrastructure as an asset class

To seize the opportunities of this critical moment and increase private investment in infrastructure LMICs can implement a series of actions. The creation of a regulatory and institutional framework which promotes private investment or the development of solid project pipelines.

Achieving the United Nations Sustainable Development Goals will require massive investment in developing countries. Blended finance, which combines concessional public funds with commercial funds, can be a powerful means to direct more commercial finance toward impactful investments that are unable to proceed on strictly commercial terms

Kathrin Heitmann, CFA, Vice President - Senior Credit Officer, Global Infrastructure and Project Finance Group, Moody's Investors Service explores data-related findings that highlight how project and infrastructure debt continued to perform well during the COVID-19 pandemic.

To celebrate International Women’s Day 2022, we interviewed three female leaders at the GI Hub to explore how we can collectively #BreakTheBias and address inequality in infrastructure. The third Q&A in this series is with Monica Bennett, GI Hub’s Director of Thought Leadership.

Equity and debt performance show that infrastructure as an asset class provides attractive and resilient returns for investors and unlisted infrastructure equities generated the highest returns and risk-adjusted returns.

To celebrate International Women’s Day 2022, we interviewed three female leaders at the GI Hub to explore how we can collectively #BreakTheBias and address inequality in infrastructure. The second Q&A in this series is with Cinthya Pastor, GI Hub’s Director of Economics.

To celebrate International Women’s Day 2022, we interviewed three female leaders at the GI Hub to explore how we can collectively #BreakTheBias and address inequality in infrastructure. The first Q&A in this series is with Maud de Vautibault, GI Hub’s Director of Practical Tools and Knowledge.

Low-income countries must maintain the necessary focus on basic goals such as improving energy access, providing safe and quality transport services, water, food security, and education - while forgoing opportunity, dealing with additional risks, and prioritising climate-smart investments.

The global pandemic and climate change concerns raised at COP26 have elevated awareness of the need to build sustainable and resilient infrastructure, in tandem with implementing adaptation strategies and governance through innovative and collaborative partnerships between the public and private sectors

Alexandra Bolton, Executive Director of the Centre for Digital Built Britain shares why we need to invest in digital capabilities to improve infrastructure delivery.

Pension investment in infrastructure is moving mainstream, at a time when this move will have even greater potential to help drive positive impacts

Improving the delivery of capital works and maintenance of water networks is essential to improving access to water and to do this, we need to rethink how we deliver infrastructure. Sydney Water has done just this with their Partnering for Success framework.

Given its share of greenhouse gas emissions, infrastructure needs to be decarbonised as part of the long-term transition to net zero and the limitation of global warming to 1.5%.

To close the infrastructure gap in a sustainable recovery, we need more greenfield infrastructure, with environmental sustainability at its core. This requires innovative funding models and public-private partnerships (PPPs), particularly in emerging economies where private investors are more reluctant to invest and greenfield infrastructure need is greatest.

Improving Delivery Models

Improving Delivery Models