958 results found

Featured results

More results

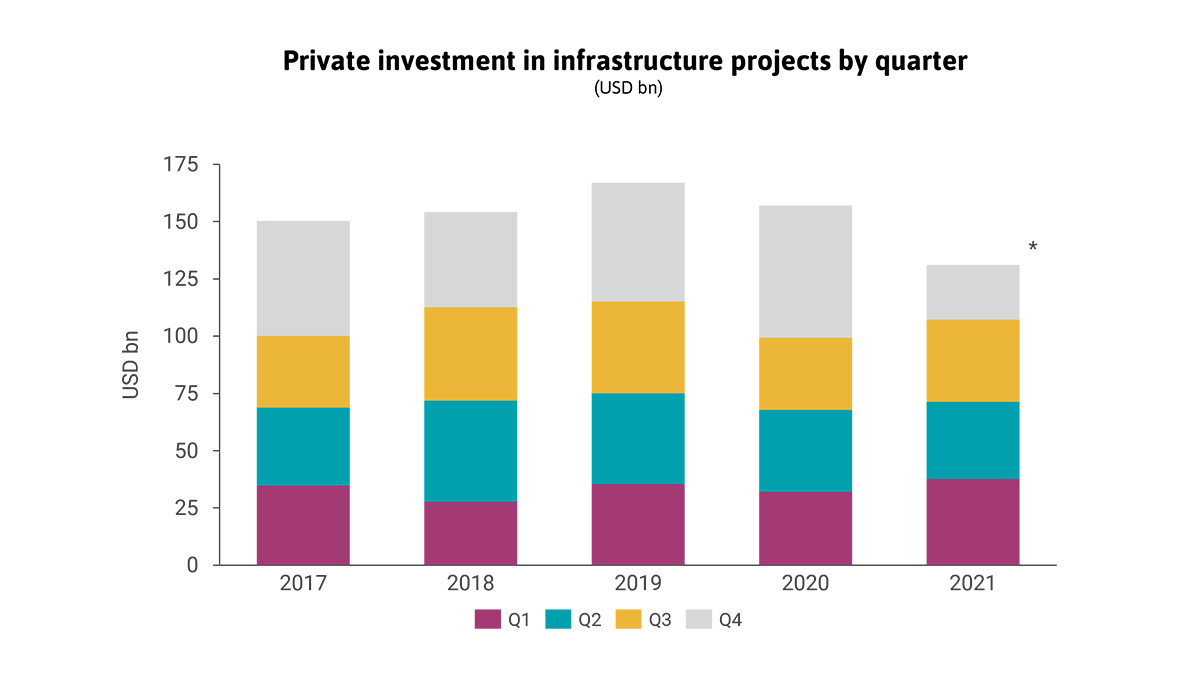

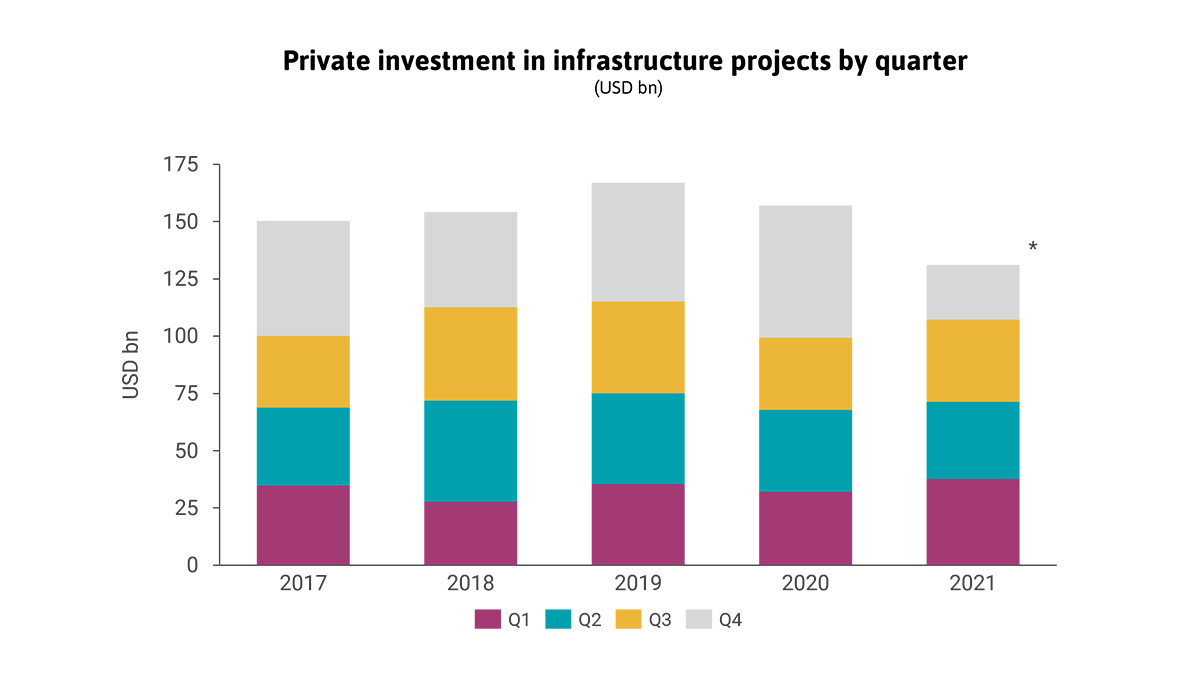

Private investment in infrastructure projects in primary markets was resilient to COVID-19 pandemic shocks

This simple and free tool enables project proponents to easily conduct early-stage cost-benefit analyses of bus transport projects.

Alexandra Bolton, Executive Director of the Centre for Digital Built Britain shares why we need to invest in digital capabilities to improve infrastructure delivery.

Pension investment in infrastructure is moving mainstream, at a time when this move will have even greater potential to help drive positive impacts

Improving the delivery of capital works and maintenance of water networks is essential to improving access to water and to do this, we need to rethink how we deliver infrastructure. Sydney Water has done just this with their Partnering for Success framework.

The policy framework for investment provides a systematic approach for improving investment conditions and a comprehensive checklist of key policy issues for consideration by any government interested in creating an enabling environment for all types of investment.

The framework provides a description of the job roles, capabilities and learning initiatives for professionals involved in project delivery.

On 19 January, the Global Infrastructure Hub hosted a seminar in collaboration with the G20 Infrastructure Working Group (IWG) on ‘Scaling up sustainable infrastructure investment by leveraging private sector participation’.

To close the infrastructure gap in a sustainable recovery, we need more greenfield infrastructure, with environmental sustainability at its core. This requires innovative funding models and public-private partnerships (PPPs), particularly in emerging economies where private investors are more reluctant to invest and greenfield infrastructure need is greatest.

Infrastructure Monitor is the GI Hub's annual flagship report on the state of investment in infrastructure.

Infrastructure Monitor is the GI Hub's flagship report on the state of investment in infrastructure. The 2021 report examines global private investment in infrastructure projects, infrastructure investment performance, project preparation, ESG factors in infrastructure investment, and COVID-19 impacts.

The recording is now available for the GI Hub and International Finance Corporation (IFC) webinar ‘Infrastructure for the recovery: Innovation for de-risking greenfield investment’, the third in the series New Deals: Funding solutions for the future of infrastructure.

These documents are used if you’re doing an IPA review. You can also use these documents if you’re doing a non-IPA review, for example, any other government review or a medium risk review.

The pandemic increased inequalities among vulnerable people and highlighted gaps in access to financing and services in every country. Simultaneously, the climate crisis is still at ‘code red’. From every vantage point, it is clear that we need to get the most possible out of the unprecedented level of infrastructure as a stimulus.

Technological innovation could fill 60% of the infrastructure investment gap, but first we need to address the barriers to financing. On 17 November 2021, the GI Hub is hosting Financing InfraTech for the Climate Transition to explore solutions to galvanise infrastructure technology adoption at scale.

Today, the GI Hub has launched a new resource that shows how G20 governments are spending the USD3.2 trillion in infrastructure as a stimulus.

This research helps governments and industry ensure that infrastructure investment supports climate mitigation and adaptation, resilience, and inclusive outcomes during challenging economic times.

The Contracts for Difference (CfD) were introduced as part of the UK's Electricity Market Reform to incentivise investment in secure, low-carbon electricity, improve the security of the UK’s electricity supply, and improve affordability for consumers.

The Pensions Infrastructure Platform was developed to facilitate long-term investment in UK infrastructure by pension schemes. It was established by UK pension schemes to operate and invest for pension schemes. It allows pension schemes of all sizes to invest in national infrastructure projects by pooling resources into a single investment fund.

Improving Delivery Models

Improving Delivery Models