923 results found

Featured results

More results

To celebrate International Women’s Day 2022, we interviewed three female leaders at the GI Hub to explore how we can collectively #BreakTheBias and address inequality in infrastructure. The first Q&A in this series is with Maud de Vautibault, GI Hub’s Director of Practical Tools and Knowledge.

Equity and debt performance show that infrastructure as an asset class provides attractive and resilient returns for investors and unlisted infrastructure equities generated the highest returns and risk-adjusted returns.

To celebrate International Women’s Day 2022, we interviewed three female leaders at the GI Hub to explore how we can collectively #BreakTheBias and address inequality in infrastructure. The second Q&A in this series is with Cinthya Pastor, GI Hub’s Director of Economics.

To celebrate International Women’s Day 2022, we interviewed three female leaders at the GI Hub to explore how we can collectively #BreakTheBias and address inequality in infrastructure. The third Q&A in this series is with Monica Bennett, GI Hub’s Director of Thought Leadership.

Kathrin Heitmann, CFA, Vice President - Senior Credit Officer, Global Infrastructure and Project Finance Group, Moody's Investors Service explores data-related findings that highlight how project and infrastructure debt continued to perform well during the COVID-19 pandemic.

Achieving the United Nations Sustainable Development Goals will require massive investment in developing countries. Blended finance, which combines concessional public funds with commercial funds, can be a powerful means to direct more commercial finance toward impactful investments that are unable to proceed on strictly commercial terms

To seize the opportunities of this critical moment and increase private investment in infrastructure LMICs can implement a series of actions. The creation of a regulatory and institutional framework which promotes private investment or the development of solid project pipelines.

The GI Hub began examining the regulatory capital treatment of infrastructure investments in 2019, as part of our initiative to address barriers to the establishment and advancement of infrastructure as an asset class

Integrating ESG into infrastructure decisions requires a systematic and verifiable governance (implementation) approach of a projects ability to reduce environmental and social risk alongside long-term value for investors

The COVID-19 pandemic boosted investors’ interest in digital infrastructure and digital services. Policymakers have an opportunity to amplify these effects by accelerating market reforms

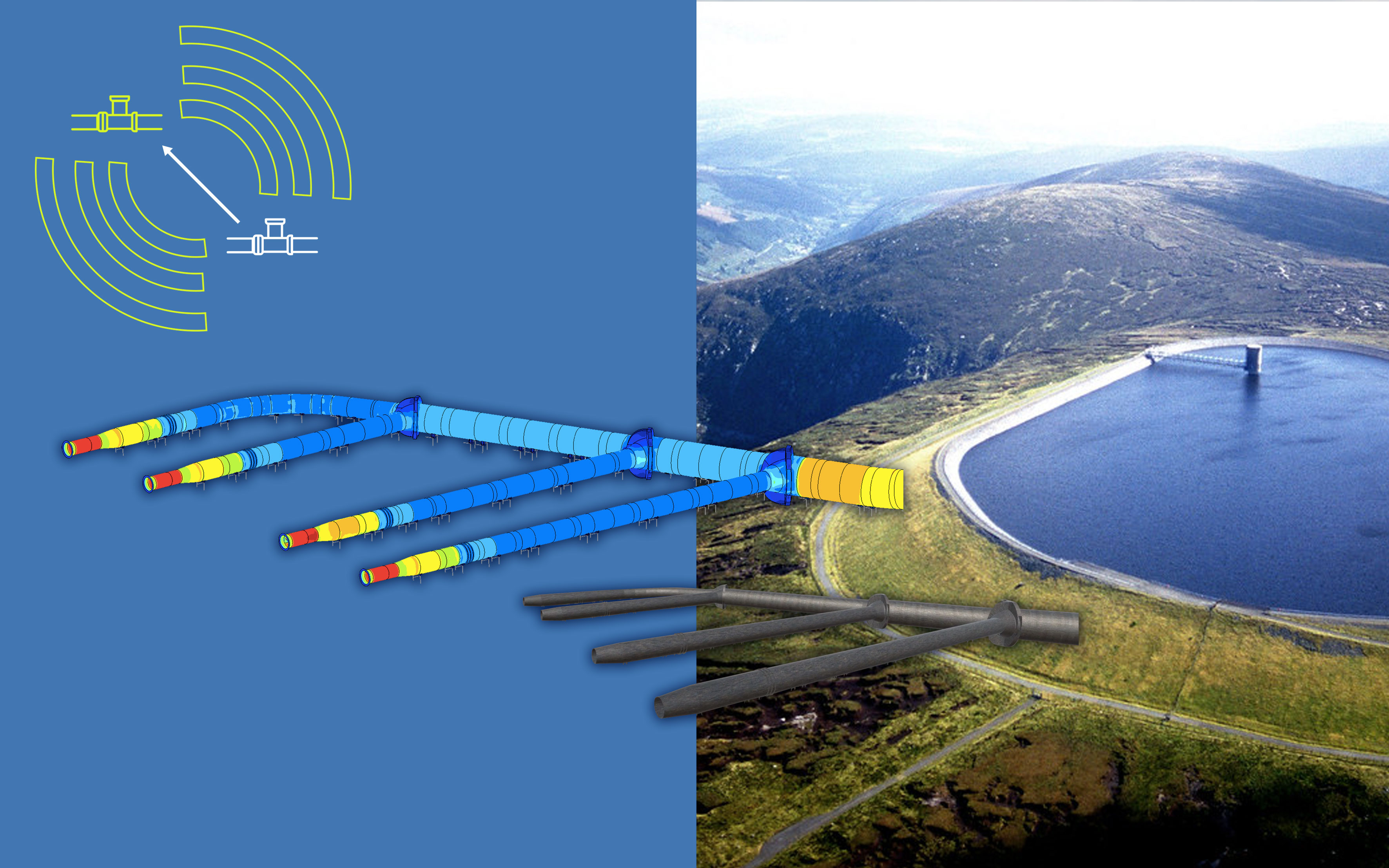

In 2019, Irish electricity company ESB was seeking a solution to help them understand the structural health of its 47-year-old Turlough Hill pumped storage station, which generates up to 292MW into the Irish grid during peak demand periods and – as Ireland’s only pumped storage station – has a crucial role in the country’s ongoing transition to renewable energy grid stabilisation.

Improving the delivery of capital works and maintenance of water networks is essential to improving access to water and to do this, we need to rethink how we deliver infrastructure. Sydney Water has done just this with their Partnering for Success framework.

Inflation continues to soar globally, the IMF forecasts inflation will rise from 4.7 percent in 2021 to 8.8 percent in 2022. In India, wholesale inflation has remained in double digits for more than a year. The IMF now expects global growth to slow from 6.0 percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023.

Open data is another aspect of digitalisation that is gaining traction. This blog explores the importance of open data to infrastructure delivery and offers some practical steps for decisionmakers in the public and private sector to implement and utilise open data.

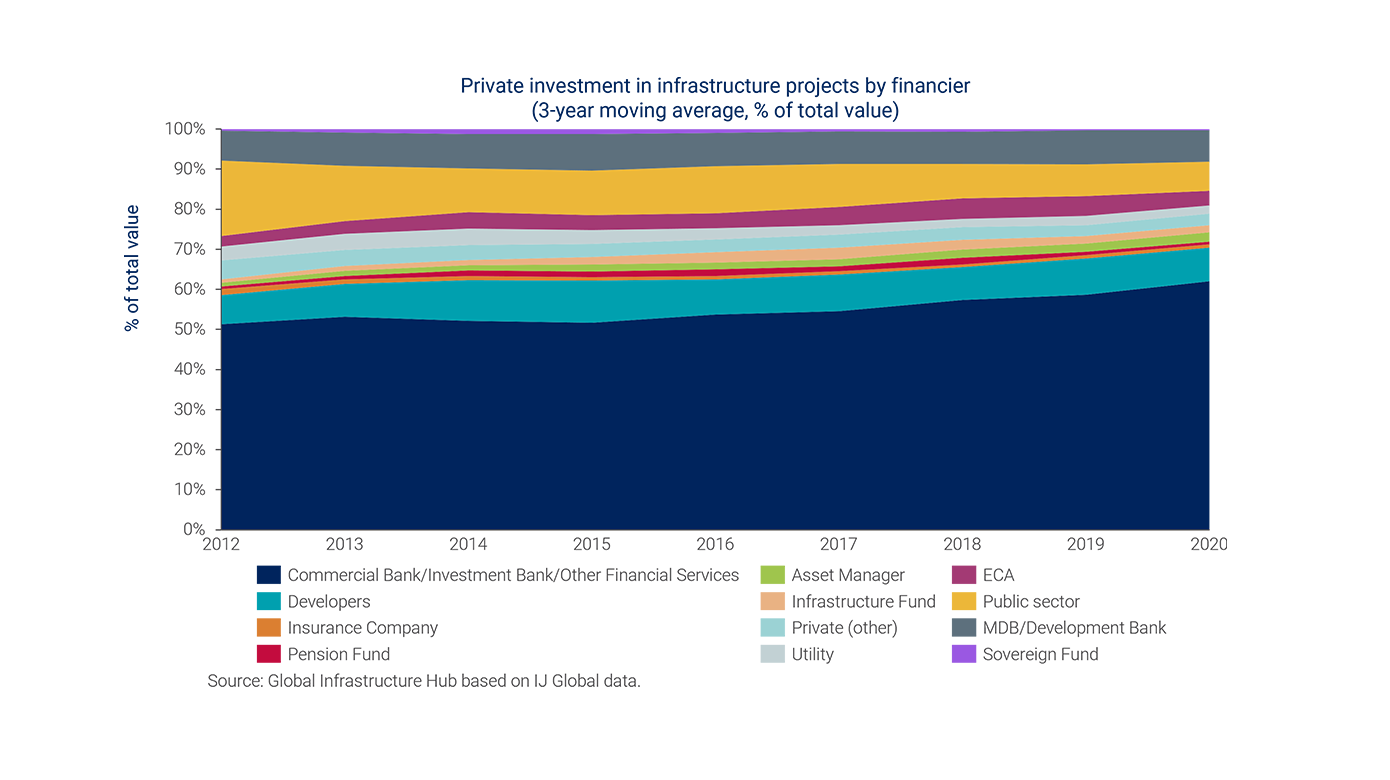

The GI Hub recently hosted a webinar that provided participants with a data-informed understanding of the state of infrastructure investment. In this article we present the main takeaways from the event.

Ahead of the G20 Finance Ministers and Central Bank Governors meeting this week, GI Hub CEO Marie Lam-Frendo provides insights into the actions we’re helping advance in our work with the G20.

The last decade has seen a growing investor appetite toward sustainable infrastructure investments. However, there are challenges to accelerating these investments at the speed and scale needed. In this article we explore two projects - the Tibar Bay Port in Timor-Leste and the Clean Ganga Program in India - that illustrate how these challenges can be overcome.

Infrastructure is key to achieving fair and sustainable economic growth and climate targets. Three trends to stimulate the private sector to fund the large-scale change to enable infrastructure to reach its climate and development potential

What qualifies as critical infrastructure, and what can governments and industry do to increase its resilience? We spoke to four experts for their perspectives.

Inclusive Infrastructure and Social Equity Tool

Inclusive Infrastructure and Social Equity Tool