1740 results found

Featured results

More results

Private infrastructure investment has been stagnant for eight years running, however the number of transactions has been trending up since 2016. This is mainly due to a tripling in the number of solar photovoltaic projects. Unfortunately, their average transaction size is the lowest among all infrastructure sector projects so does not translate to an increase in the total private investment amount.

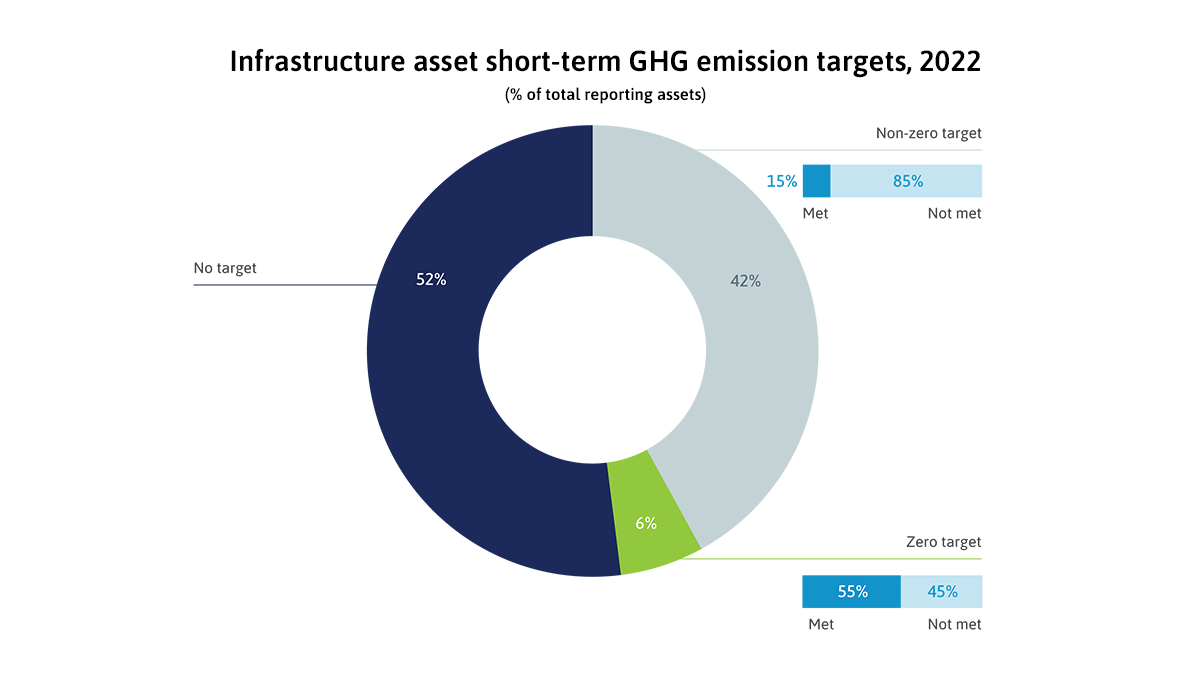

In 2022, infrastructure assets improved their ESG scores in all three pillars of ESG. The scores are encouraging, but they do not mean the assets themselves are more sustainable.

The credit risk metrics for infrastructure debt improved during the COVID-19 pandemic, while those for non-infrastructure debt worsened. The performance of infrastructure loans demonstrates that infrastructure assets are resilient to adverse economic scenarios like pandemics.

The higher risk profile of greenfield infrastructure, and lack of investment-ready project pipelines, make it challenging to deploy private investment to greenfield infrastructure.

The number of primary private infrastructure transactions increased by 18% in 2022, the strongest annual growth since 2017, largely driven by strong investor appetite for projects supporting the clean energy transition. However, growth was mostly being driven by high-income countries in North America and Western Europe, with private investment activity in middle- and low-income countries seeing a lot less momentum with volumes on par with pre-COVID levels.

Regional private investment in infrastructure has seen divergent trends in the post-COVID era, with Western Europe and North America emerging as the two strongest performers, followed by Latin America. Meanwhile Asia, while maintaining relatively stable investment as a share of regional GDP, has experienced the sharpest decline in its share of global private investment in infrastructure, as Western Europe and North America expand their shares. Other regions have seen weaker investment in the post-COVID era (Africa, Oceania, Middle East), or remained stagnant (Eastern Europe).

In low- and middle-income countries (LMICs), around three-quarters of private investment in infrastructure is conducted in foreign currencies, most commonly USD, and only a quarter in local currencies. Brazil dominates local currency transactions in LMICs and has driven a trend increase in the share of local currency transactions in LMIC investment since 2016.

The GI Hub’s InfraTracker aims to help address this data gap by analysing public investment data presented in G20 government budgets

Comparison of InfraTracker data with private investment figures in Infrastructure Monitor also indicate that, in general, governments are the driver of investment in all infrastructure sectors except for energy.

Infrastructure investment undoubtedly has a strong impact on economic growth and development.

The Addis Ababa-Djibouti Railway modernisation project is the first cross-border electrified railway in Africa

The N4 Toll Route is a brownfield toll road concession of 630 kilometres running from Pretoria, South Africa?s administrative capital, to Maputo, the capital of Mozambique and a deep-sea port on the Indian Ocean.

The Øresund Fixed Link (the Link) is a combined bridge and tunnel link across the Øresund Sound (the Sound) between Denmark and Sweden.

The Channel Tunnel is a roughly 50 kilometre-long rail tunnel linking Folkestone, Kent, in England, with Coquelles, Pas-de-Calais, near Calais in northern France, beneath the English Channel at the Strait of Dover.

The Coral Sea Cable System (CS2) is a 4700 kilometre-long fibre optic submarine telecommunications cable that links both Papua New Guinea and Solomon Islands to the major East Coast Internet Hub in Sydney, Australia.

The Gordie Howe International Bridge is a land border crossing between Windsor, Ontario, Canada and Detroit, Michigan in the United States (US).

The Itaipu Hydroelectric Dam (the Dam) is located on the Paraná River on the border between Brazil and Paraguay

After 99% of Queensland was declared a natural disaster zone due to the cumulative effects of Cyclone Yasi and widespread flooding, the Australian Federal Government imposed a one-off levy to finance AUD1.8 billion to rebuild infrastructure.

The rapid growth in Indonesia’s urban areas required a rapid scale up in infrastructure investment. The Government of Indonesia set up Indonesia Infrastructure Guarantee Fund (IIGF) as a state-owned enterprise (SOE) to leverage private investments in infrastructure projects by providing government guarantees or credit enhancements to PPP projects.

The Contracts for Difference (CfD) were introduced as part of the UK's Electricity Market Reform to incentivise investment in secure, low-carbon electricity, improve the security of the UK’s electricity supply, and improve affordability for consumers.

Infrastructure Monitor insights

Infrastructure Monitor insights