928 results found

Featured results

More results

Infrastructure 100, a global panel of independent industry experts identified 100 of the world s most inspirational and innovative infrastructure projects.

The Infrastructure Finance in the Developing World Working Paper Series is a joint research effort by the Global Green Growth Institute and the G-24 that explores the challenges and opportunities for scaling up infrastructure finance in emerging markets and developing countries.

This paper expands upon existing literature by proposing a wider definition of what constitutes green infrastructure. We then develop a holistic cost model by defining and quantifying the investment categories that should be considered part of green infrastructure.

Infrastructure Financing Trends in Africa – 2017 is the Infrastructure Consortium for Africa’s (ICA’s) annual report on how financial resources are being mobilised to facilitate the development of the continent’s transport, water and sanitation, energy and ICT sectors.

The Nabarro Infrastructure Index is a composite index, based on empirical and verifiable sources, which have been aggregated and weighted for application to listed countries to provide a unique tool to assist in the decision-making process.

The Infrastructure Investment Policy Blueprint offers a practical set of recommendations for governments on attracting private capital for infrastructure projects while creating clear social and economic value for their citizens.

Infrastructure Monitor identifies and analyses global trends in private investment in infrastructure to inform future investment and policy.

Infrastructure Monitor is the GI Hub's annual flagship report on the state of investment in infrastructure.

Infrastructure Monitor is the GI Hub's flagship report on the state of investment in infrastructure. The 2021 report examines global private investment in infrastructure projects, infrastructure investment performance, project preparation, ESG factors in infrastructure investment, and COVID-19 impacts.

This paper discusses some of the main challenges in developing a robust and viable project pipeline to address the daunting infrastructure needs facing many countries worldwide.

A new GI Hub initiative, launching in November 2021, tracks the amount of infrastructure as a stimulus announced by G20 governments and presents data insights that will help governments, investors, multilateral development banks, and project directors achieve transformative outcomes from infrastructure in the post-COVID-19 recovery.

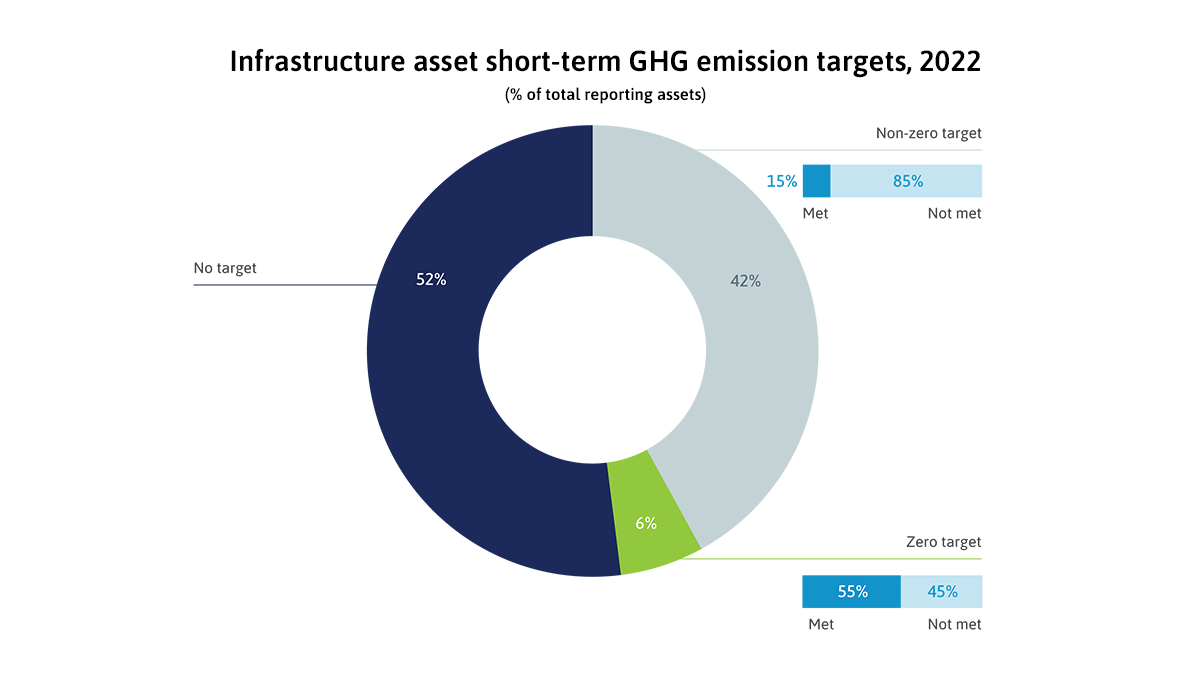

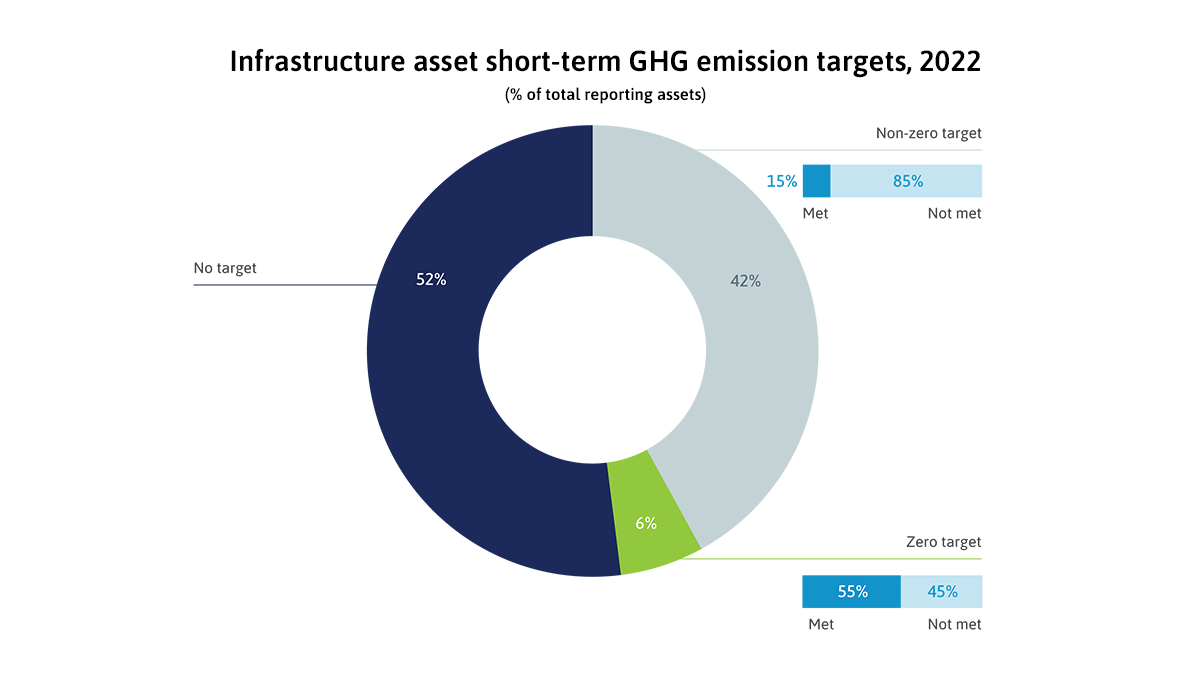

In 2022, infrastructure assets improved their ESG scores in all three pillars of ESG. The scores are encouraging, but they do not mean the assets themselves are more sustainable.

A new global survey of major international institutional investors has found strong investor demand for infrastructure, including record levels of interest in emerging market infrastructure with 37.5% of all investors now active in these growing markets.

The credit risk metrics for infrastructure debt improved during the COVID-19 pandemic, while those for non-infrastructure debt worsened. The performance of infrastructure loans demonstrates that infrastructure assets are resilient to adverse economic scenarios like pandemics.

Infrastructure debt has a highly attractive and resilient risk-return profile for investors. Expected losses are particularly low given high recovery rates in cases of default

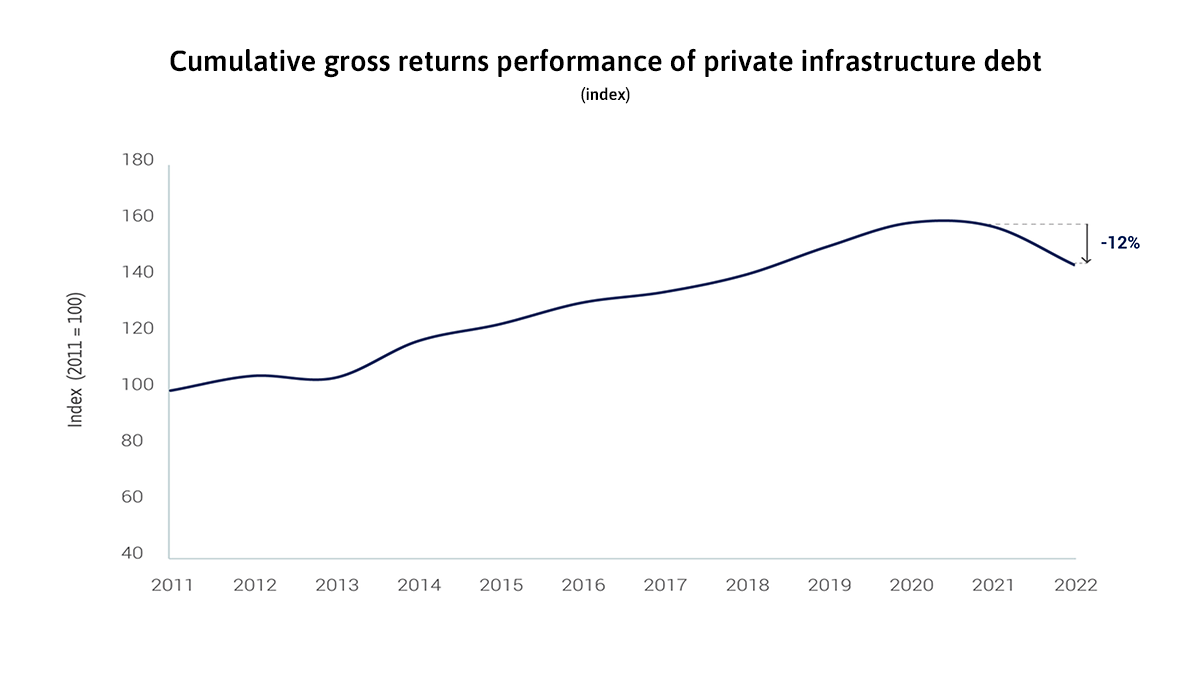

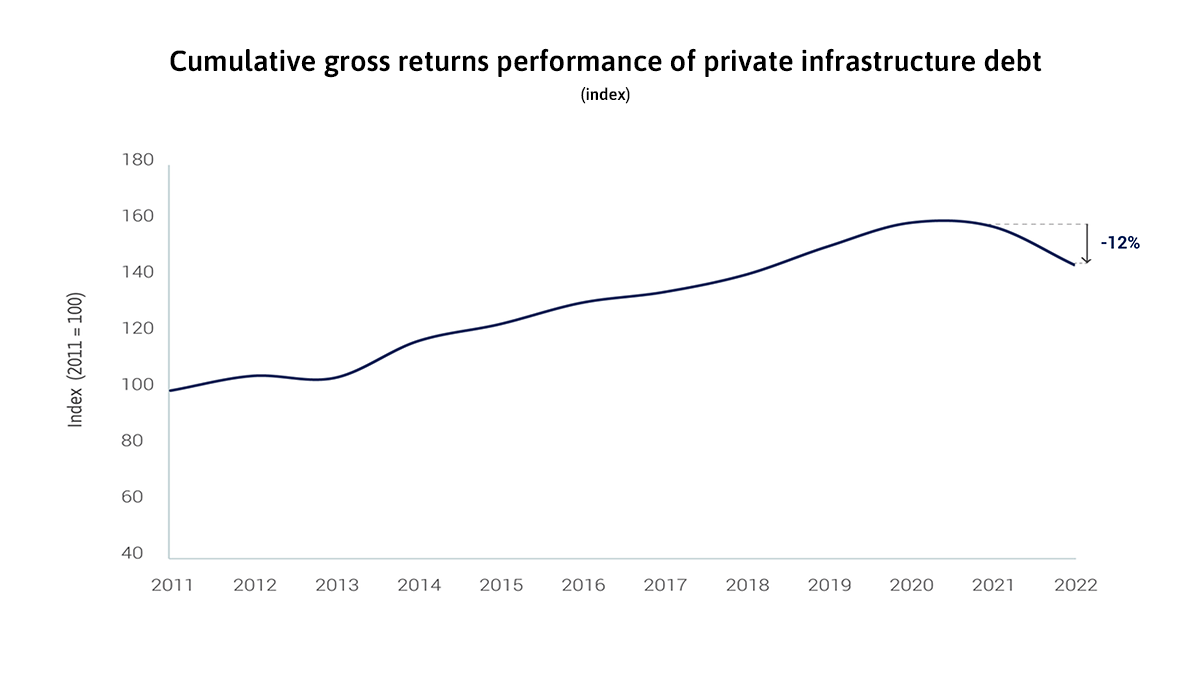

Rapid and sharp interest rate hikes in 2022 lowered the market value of existing infrastructure debt locked-in at the previous lower rates. Still, the attractiveness of infrastructure debt increased among private investors on account of its lower credit risk than corporate debt and increasing investors’ risk aversion

Kathrin Heitmann, CFA, Vice President - Senior Credit Officer, Global Infrastructure and Project Finance Group, Moody's Investors Service explores data-related findings that highlight how project and infrastructure debt continued to perform well during the COVID-19 pandemic.

Amidst rising interest rates and soaring inflation, infrastructure debt is an increasingly attractive investment strategy for private investors. Alex Murray, Vice President, Research Insights, Preqin explores this trend and what it means for infrastructure investments.

Infrastructure Monitor

Infrastructure Monitor