961 results found

Featured results

More results

Infrastructure is key to achieving fair and sustainable economic growth and climate targets. Three trends to stimulate the private sector to fund the large-scale change to enable infrastructure to reach its climate and development potential

The QII Principles are voluntary, non-binding principles that reflect a common strategic direction and aspiration for quality infrastructure investment.

The Blueprint provides a set of evidence-based, voluntary, non-binding actions to advance the six elements of the G20 InfraTech Agenda.

The QII Principles are voluntary, non-binding principles that reflect a common strategic direction and aspiration for quality infrastructure investment.

Co-financing provide a supportive enabling environment that minimises risk exposures, catalysing private co-financing for infrastructure in middle- and low-income countries.

Last week, the GI Hub facilitated an infrastructure roundtable in Toronto with Canadian private sector participants, industry associations, and government infrastructure agencies.

Deloitte's Analytics Institute published this analysis of how new technology and data analytics can be used for predictive maintenance.

The LTIIA's report on Climate-Resilient Infrastructure: How to scale up private investment examines the current state of climate-resilient infrastructure investment and brings forward recommendations and proposals.

Inflation continues to soar globally, the IMF forecasts inflation will rise from 4.7 percent in 2021 to 8.8 percent in 2022. In India, wholesale inflation has remained in double digits for more than a year. The IMF now expects global growth to slow from 6.0 percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023.

In 2021, the G20 Finance Ministers and Central Bank Governors asked the G20's Sustainable Finance Working Group (SFWG) to develop a multi-year G20 Sustainable Finance Roadmap identifying the G20’s sustainable finance priorities, and to work on specific priority areas. This report characterises challenges, reviews existing practices, and proposes a set of recommendations to progress in the priority areas.

This paper from EDHECinfra explores how institutional investors should incorporate ESG elements into the financial management of their portfolios.

This report leverages the experience of NGFS members and observers, as well as a survey of 25 central banks and 24 financial supervisors, to examine key challenges related to market transparency in green finance - particularly with regard to taxonomies; green external review and assessment; and climate transition metrics, frameworks, and market products. It also aims to inform a broad dialogue with market participants to find potential solutions to policy challenges.

The G20/GI Hub Framework on How to Best Leverage Private Sector Participation to Scale Up Sustainable Infrastructure, which sets out opportunity areas and actions for the G20 to enable the private sector to scale up its investments in sustainable infrastructure.

‘Revitalising infrastructure investment’ was a focus at the recent G20 FMCBG meeting, and GI Hub-led work on sustainable investment and public infrastructure spending was endorsed.

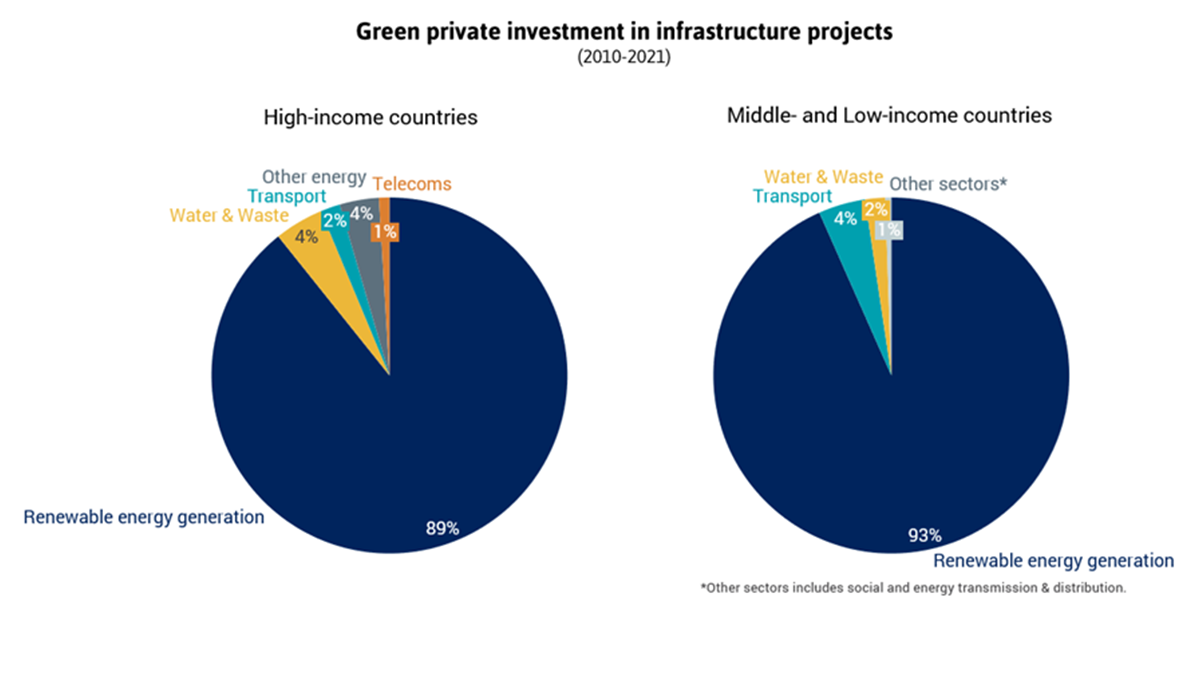

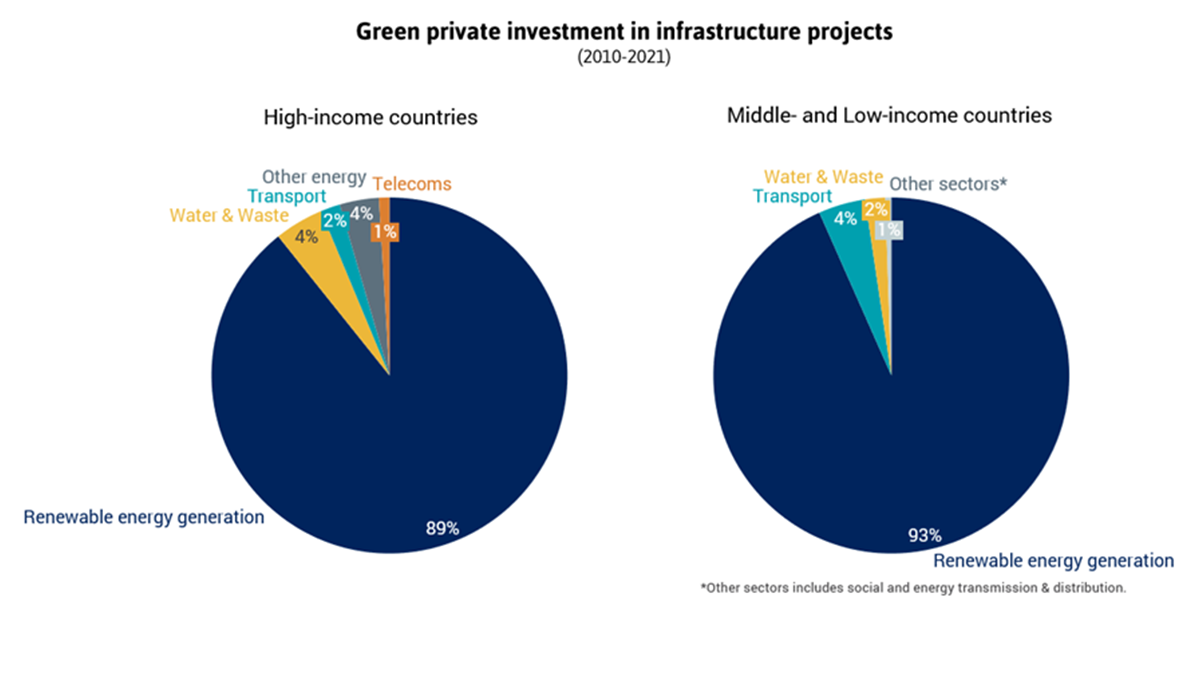

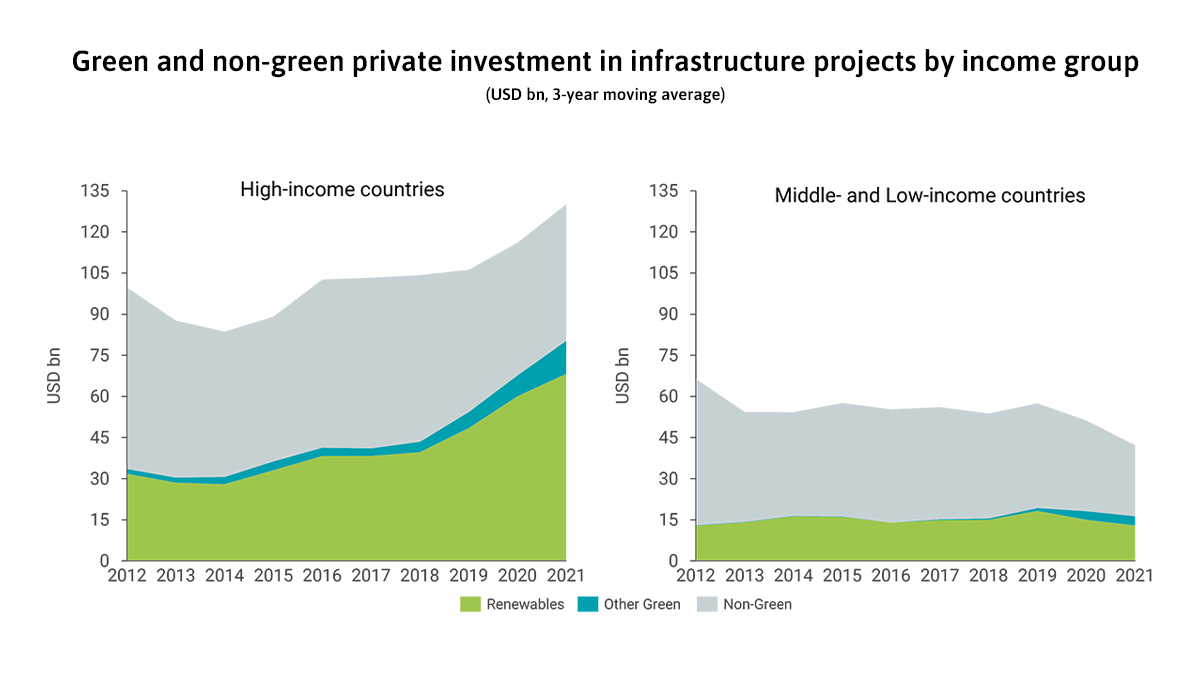

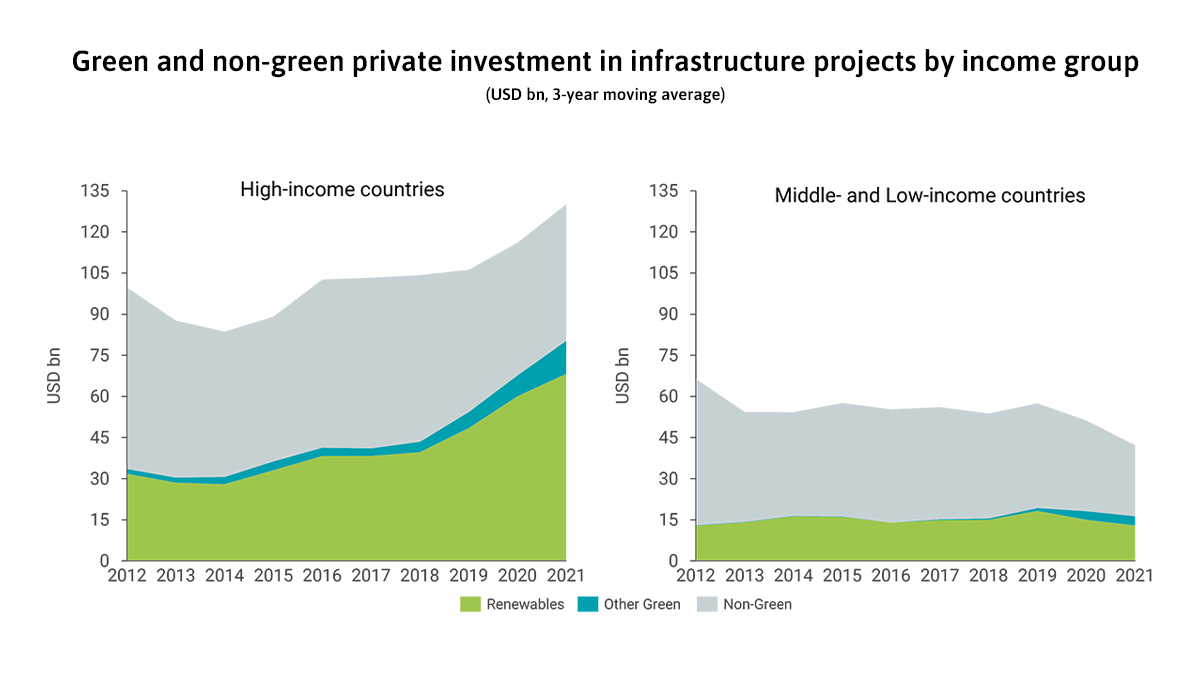

Green investment in infrastructure outside of renewables is limited. While renewables represent almost 90% of total green private investments in infrastructure projects, green investment in other sectors only represent 14%.

In 2021, global green private investment in infrastructure projects in primary markets rose to a record-high share of 60%, but this trend needs to accelerate and expand beyond renewables to meet climate goals.

The Global Infrastructure Investor Association, in partnership with Marsh & McLennan, examines the impacts that rapid technological advancement are having on infrastructure assets around the world and what these will mean for the sector in years to come.

Funding and Financing Solutions

Funding and Financing Solutions