Insights

Filter by

38 results found

Non-private institutions, such as multilateral development banks, play a critical role in catalyzing private infrastructure investment in low- and middle-income countries (LMIC). One avenue of support is through the direct co-financing of projects, with over half (55%) of total LMIC investment involving non-private co-financing in 2022. However, the share of LMIC investment financed by the private sector alone has been increasing over time. This has been driven by the renewables sector, reflecting increasing investor confidence in a maturing market as well as relatively smaller project sizes. In general, private sector investors are less likely to require co-financing support from non-private entities in larger LMIC markets, such as Brazil, Russia, India and South Africa.

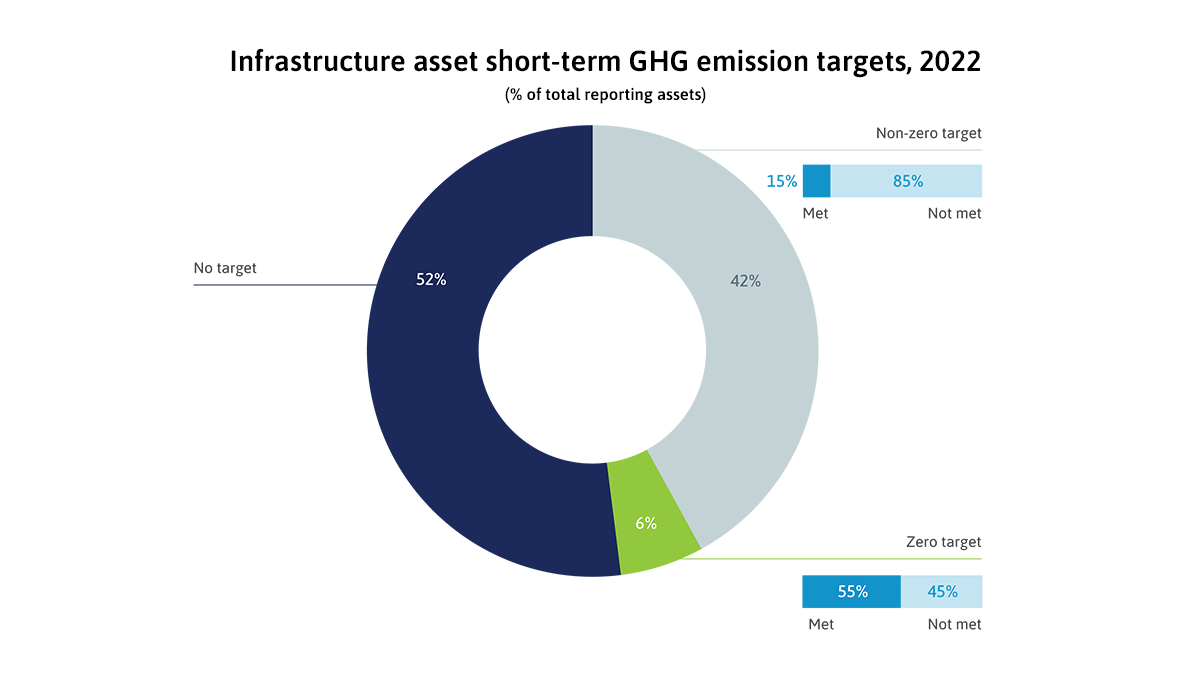

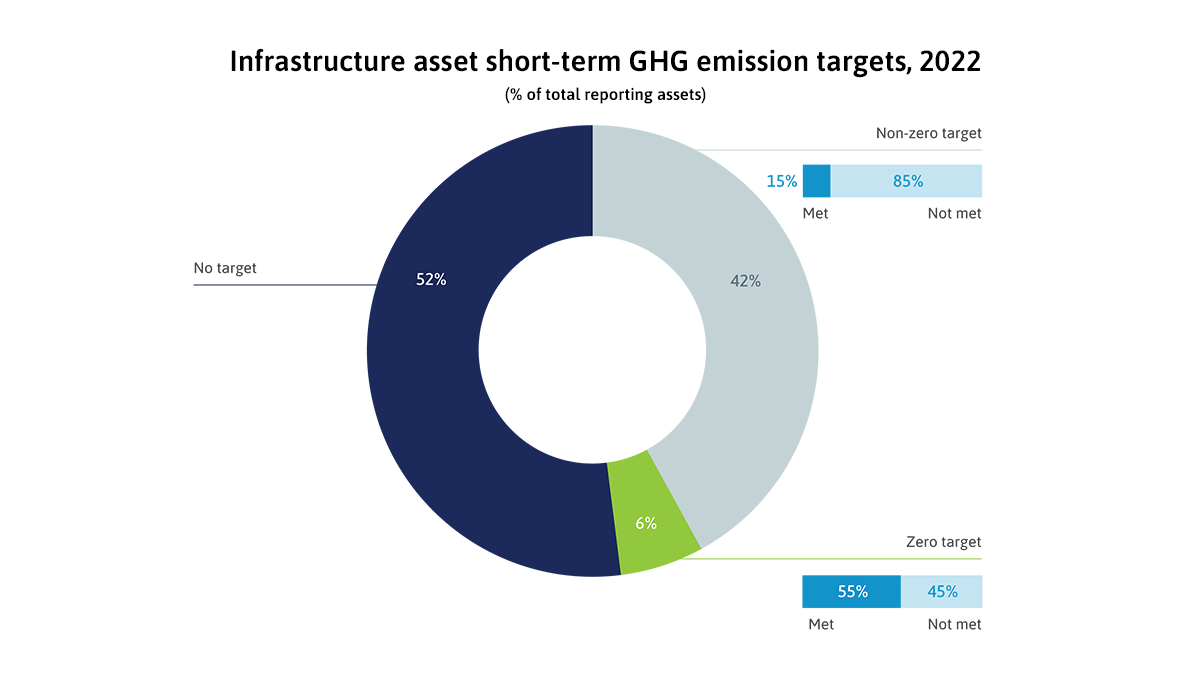

60% of infrastructure assets reporting to GRESB in 2023 currently have a greenhouse gas (GHG) emissions reduction target aligned to net zero. However, these net zero targets may not be ambitious enough. Only a third of assets have a target that is science-based or aligned to a net zero-targeting framework. Further, targets tend to capture only Scope 1 and 2 emissions (omitting Scope 3 emissions) and be location, rather than market-based. However, regional variances exist, with Europe leading the way in Scope 3 and market-based net zero targeting.

In low- and middle-income countries (LMICs), around three-quarters of private investment in infrastructure is conducted in foreign currencies, most commonly USD, and only a quarter in local currencies. Brazil dominates local currency transactions in LMICs and has driven a trend increase in the share of local currency transactions in LMIC investment since 2016.

Regional private investment in infrastructure has seen divergent trends in the post-COVID era, with Western Europe and North America emerging as the two strongest performers, followed by Latin America. Meanwhile Asia, while maintaining relatively stable investment as a share of regional GDP, has experienced the sharpest decline in its share of global private investment in infrastructure, as Western Europe and North America expand their shares. Other regions have seen weaker investment in the post-COVID era (Africa, Oceania, Middle East), or remained stagnant (Eastern Europe).

The number of primary private infrastructure transactions increased by 18% in 2022, the strongest annual growth since 2017, largely driven by strong investor appetite for projects supporting the clean energy transition. However, growth was mostly being driven by high-income countries in North America and Western Europe, with private investment activity in middle- and low-income countries seeing a lot less momentum with volumes on par with pre-COVID levels.

The higher risk profile of greenfield infrastructure, and lack of investment-ready project pipelines, make it challenging to deploy private investment to greenfield infrastructure.

The credit risk metrics for infrastructure debt improved during the COVID-19 pandemic, while those for non-infrastructure debt worsened. The performance of infrastructure loans demonstrates that infrastructure assets are resilient to adverse economic scenarios like pandemics.

In 2022, infrastructure assets improved their ESG scores in all three pillars of ESG. The scores are encouraging, but they do not mean the assets themselves are more sustainable.

Private infrastructure investment has been stagnant for eight years running, however the number of transactions has been trending up since 2016. This is mainly due to a tripling in the number of solar photovoltaic projects. Unfortunately, their average transaction size is the lowest among all infrastructure sector projects so does not translate to an increase in the total private investment amount.

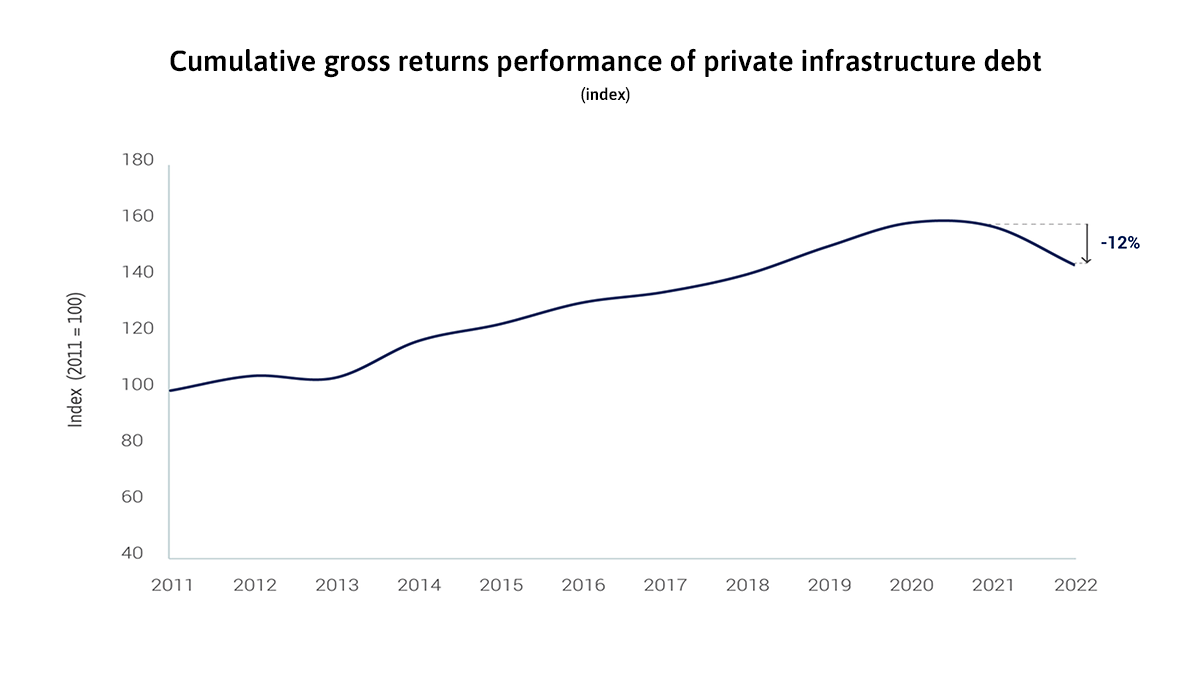

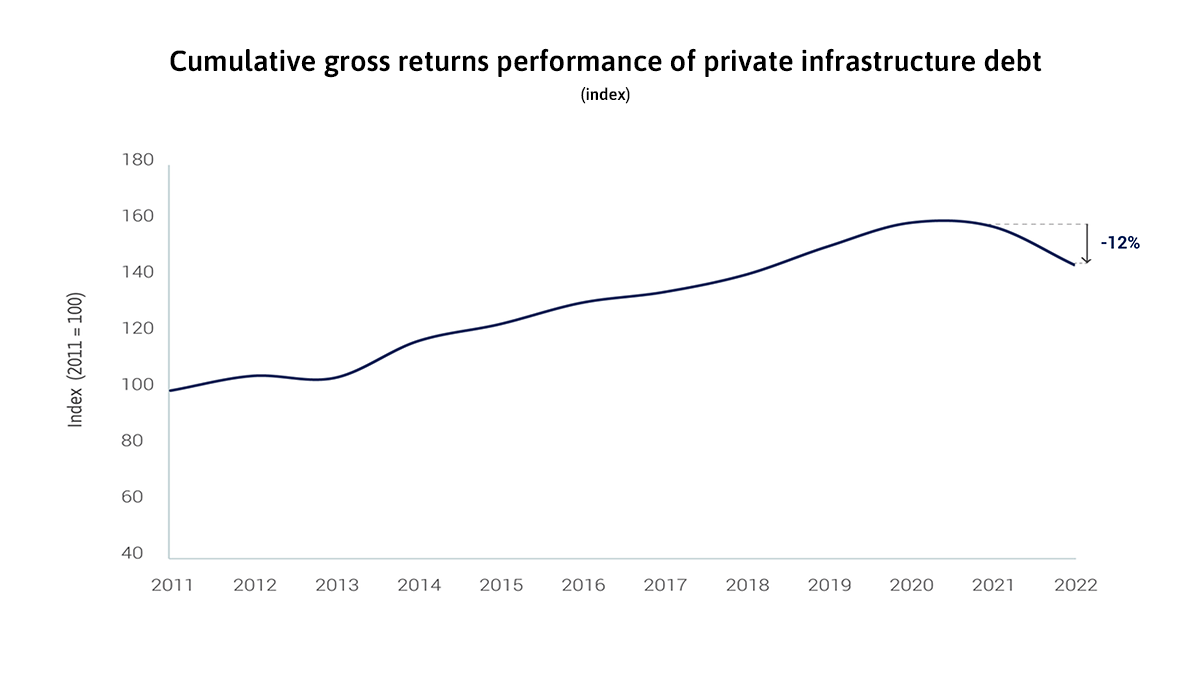

Rapid and sharp interest rate hikes in 2022 lowered the market value of existing infrastructure debt locked-in at the previous lower rates. Still, the attractiveness of infrastructure debt increased among private investors on account of its lower credit risk than corporate debt and increasing investors’ risk aversion

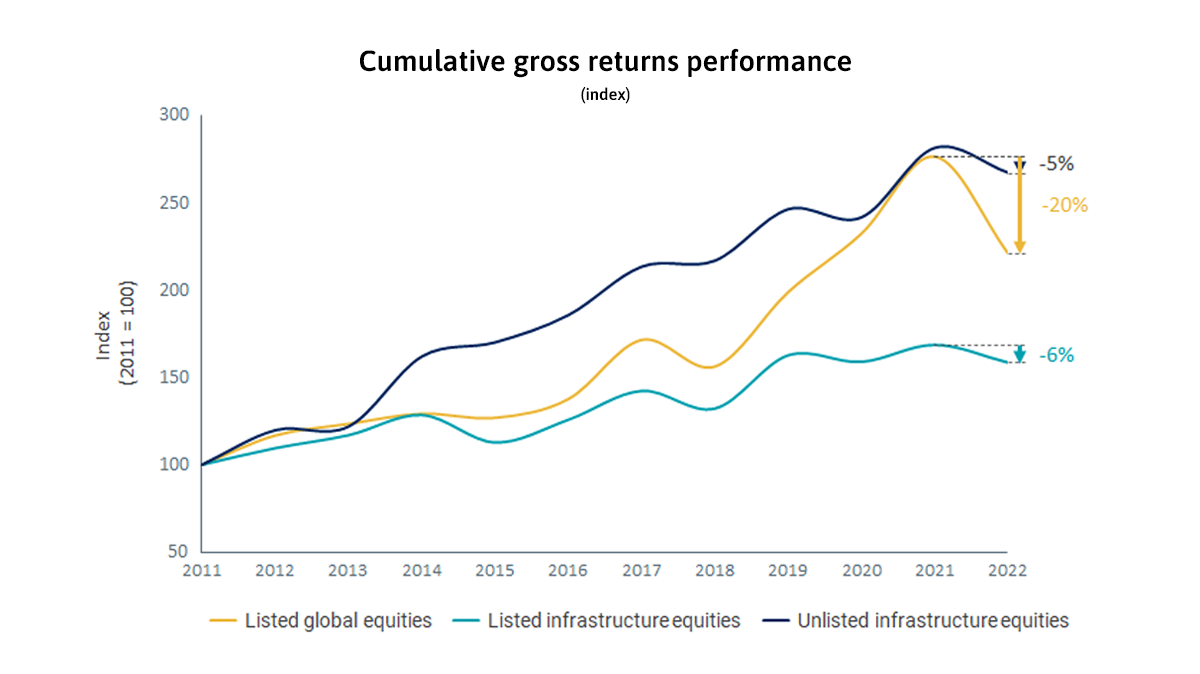

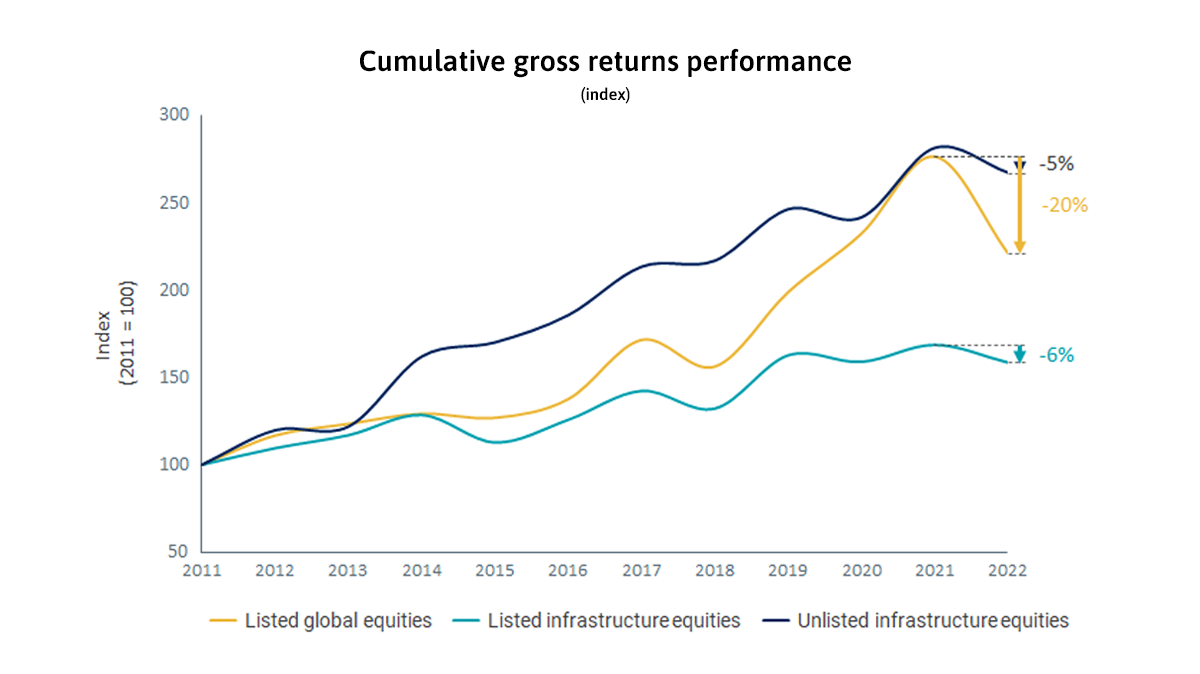

Infrastructure equities provide stronger protection against inflation shocks than the broader equity market. During the rapid inflation shocks in 2022, the return on infrastructure equities was more resilient than that on global equities, which drove private fundraising for infrastructure to record levels.

In 2021, private investment in infrastructure projects in primary markets recovered to its pre-pandemic level but remains stagnant and far shy of what is needed to close the infrastructure investment gap.

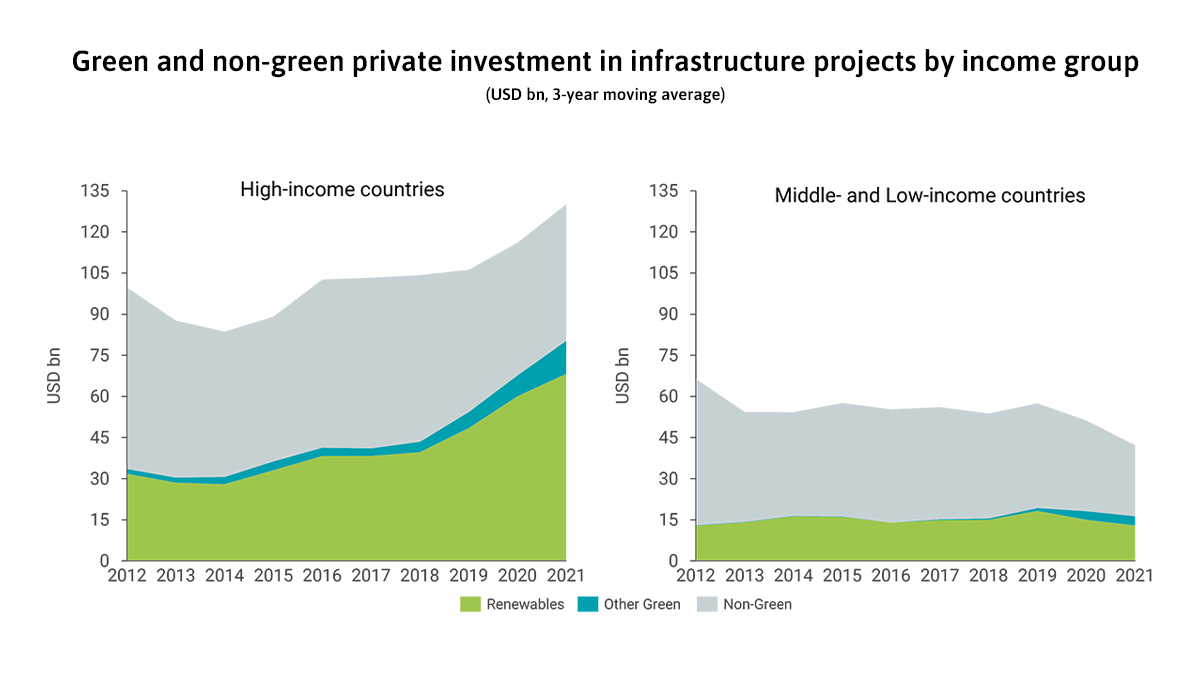

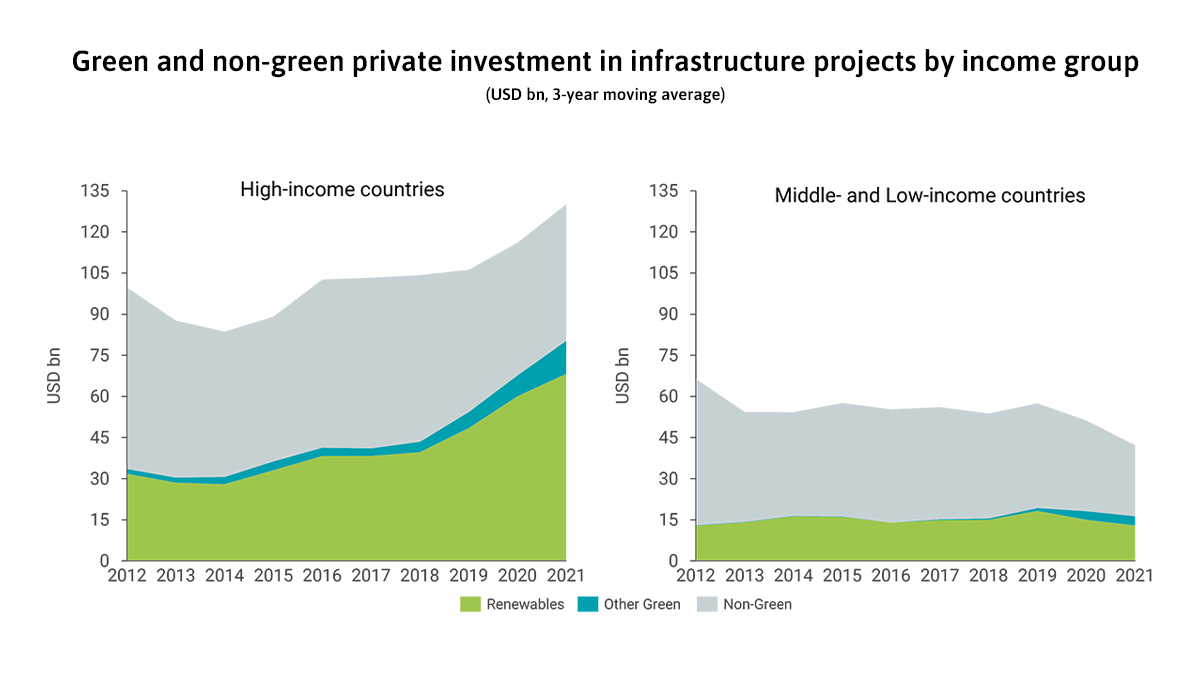

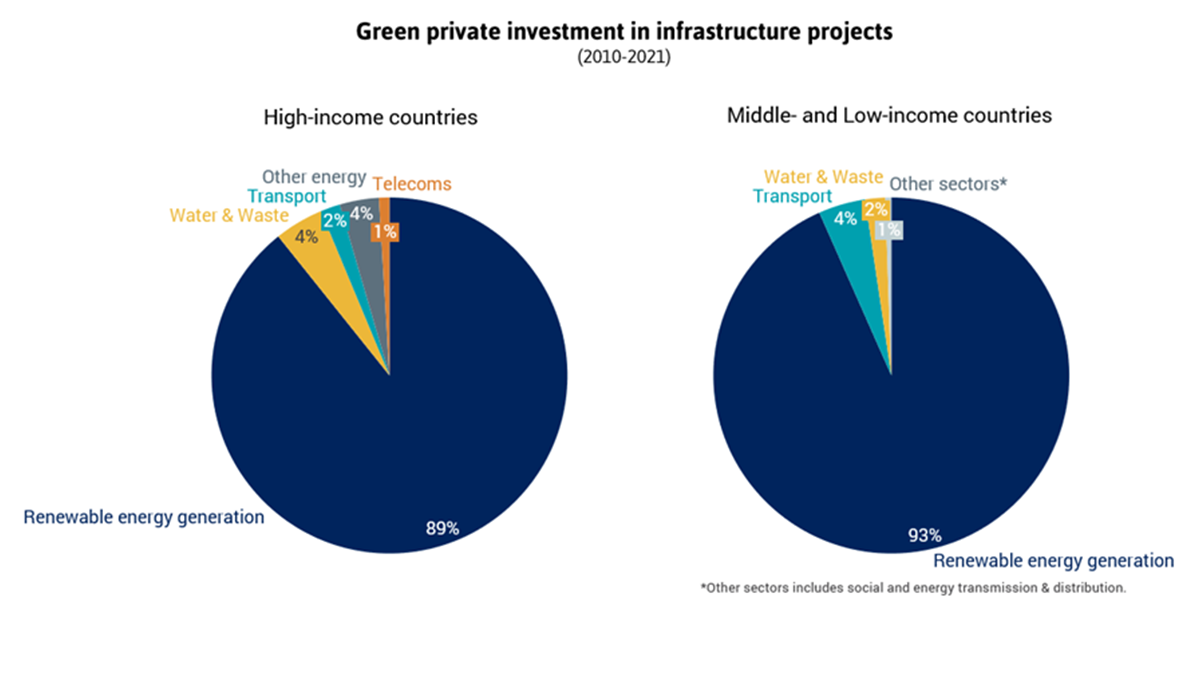

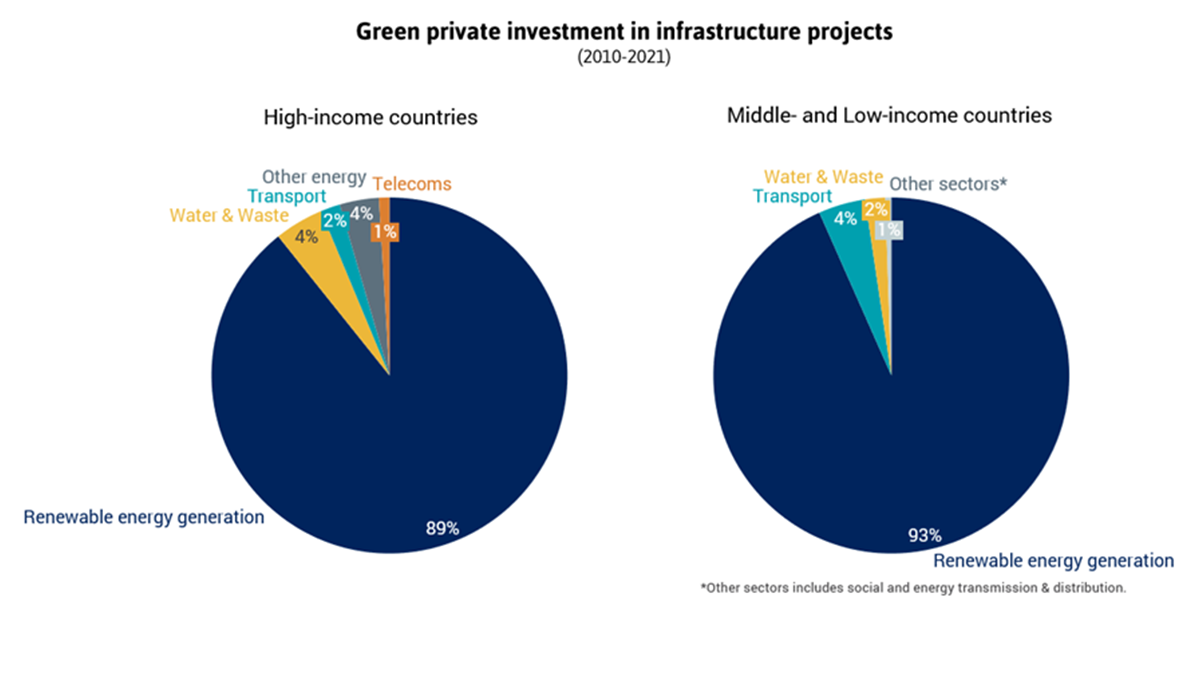

In 2021, global green private investment in infrastructure projects in primary markets rose to a record-high share of 60%, but this trend needs to accelerate and expand beyond renewables to meet climate goals.

Green investment in infrastructure outside of renewables is limited. While renewables represent almost 90% of total green private investments in infrastructure projects, green investment in other sectors only represent 14%.

Co-financing provide a supportive enabling environment that minimises risk exposures, catalysing private co-financing for infrastructure in middle- and low-income countries.

The green bond market has seen exponential growth since its inception in 2007. In 2020, green bonds represented 60% of bond issuances for private investment in sustainable, primary infrastructure globally, mostly concentrated in developed regions.

Preliminary evidence shows superior performance for some sustainable infrastructure investments in comparison with other infrastructure sector investments

Private investors have shifted away from non-renewables in both developed and developing markets. The appetite for renewables is stronger in developed markets.

Low private investment in the social, telecommunications, water and waste infrastructure sectors

Private investment in infrastructure is dominated by the energy and transport sectors

Infrastructure Monitor insights

Infrastructure Monitor insights