56 results found

Preliminary evidence shows superior performance for some sustainable infrastructure investments in comparison with other infrastructure sector investments

Private investors have shifted away from non-renewables in both developed and developing markets. The appetite for renewables is stronger in developed markets.

Low private investment in the social, telecommunications, water and waste infrastructure sectors

Private investment in infrastructure is dominated by the energy and transport sectors

Infrastructure project preparation capacity is weak across most regions of the world. It is critical to strengthen these capabilities to address one of the major bottlenecks in attracting private capital to infrastructure, which is the lack of a bankable, investment-ready pipeline of infrastructure projects

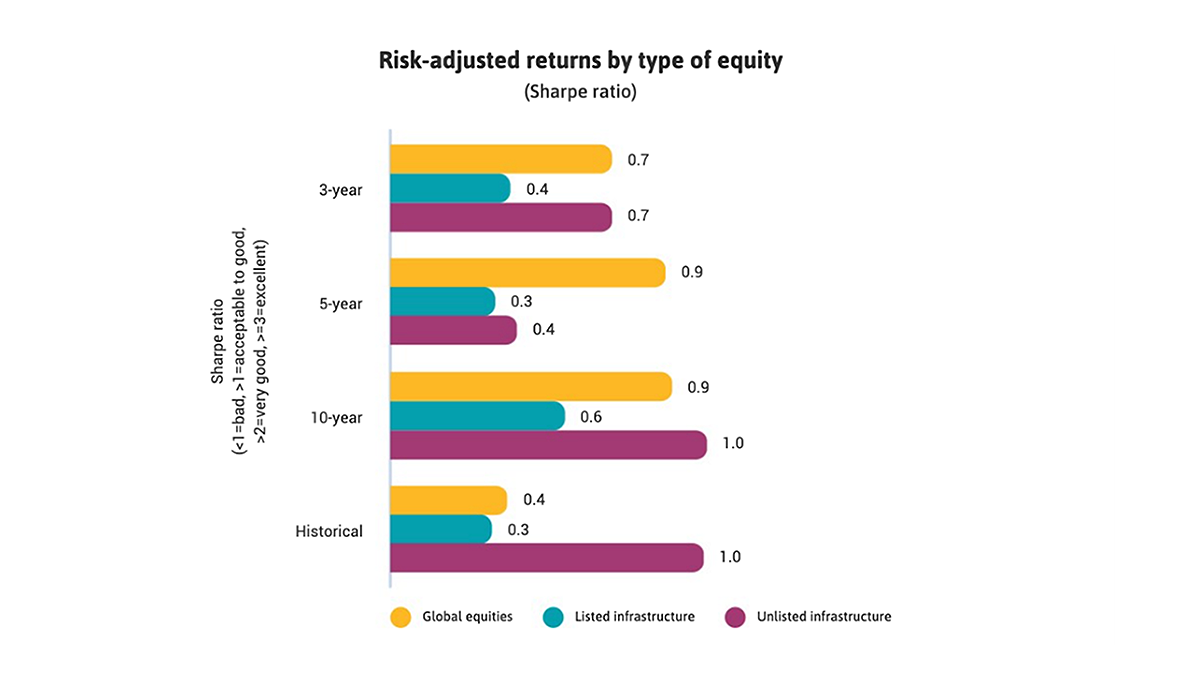

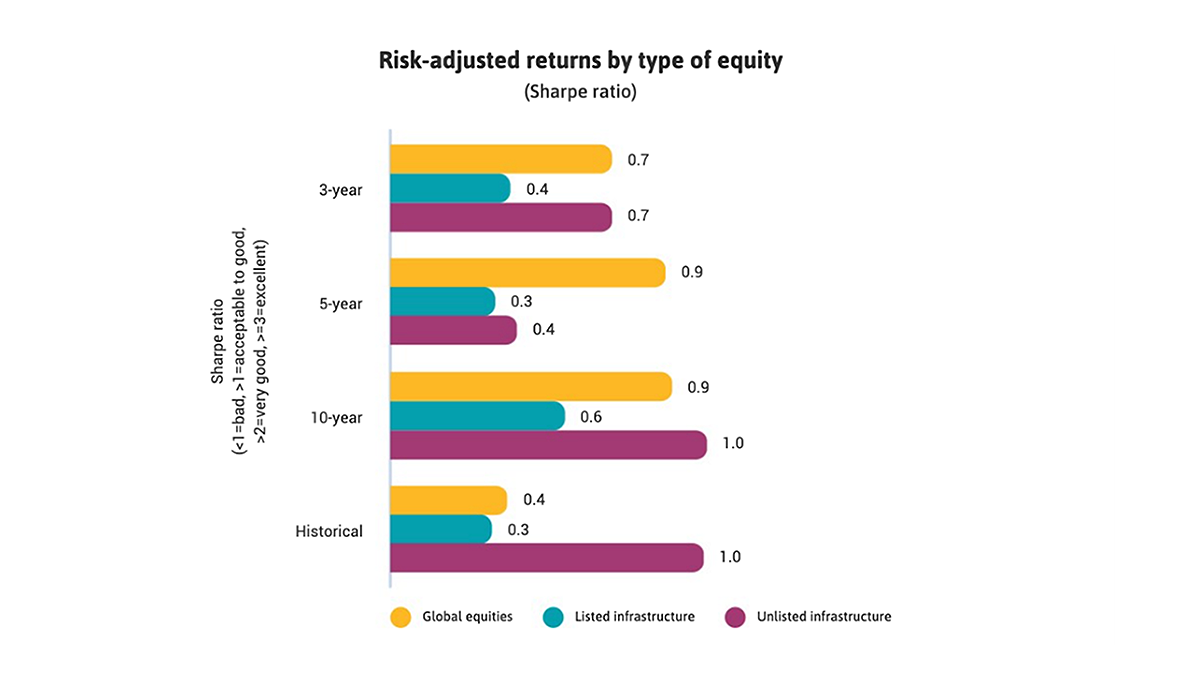

For investors seeking to diversify and optimise their portfolios, infrastructure debt and unlisted infrastructure equities are very strong options, according to long-term data

Unlisted infrastructure equities have provided higher risk-adjusted returns to investors than an average global listed equity. With greater recognition of its attractive performance, investors’ demand has increased, and returns have aligned over time with its lower risk or volatility

Infrastructure debt has a highly attractive and resilient risk-return profile for investors. Expected losses are particularly low given high recovery rates in cases of default

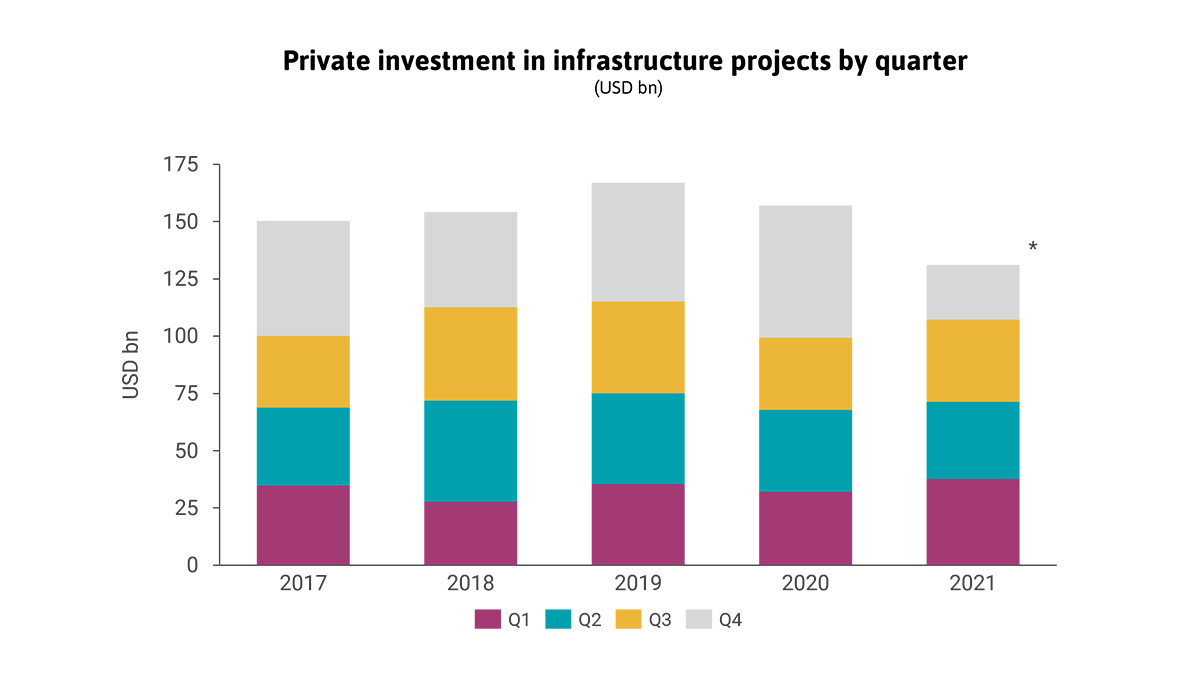

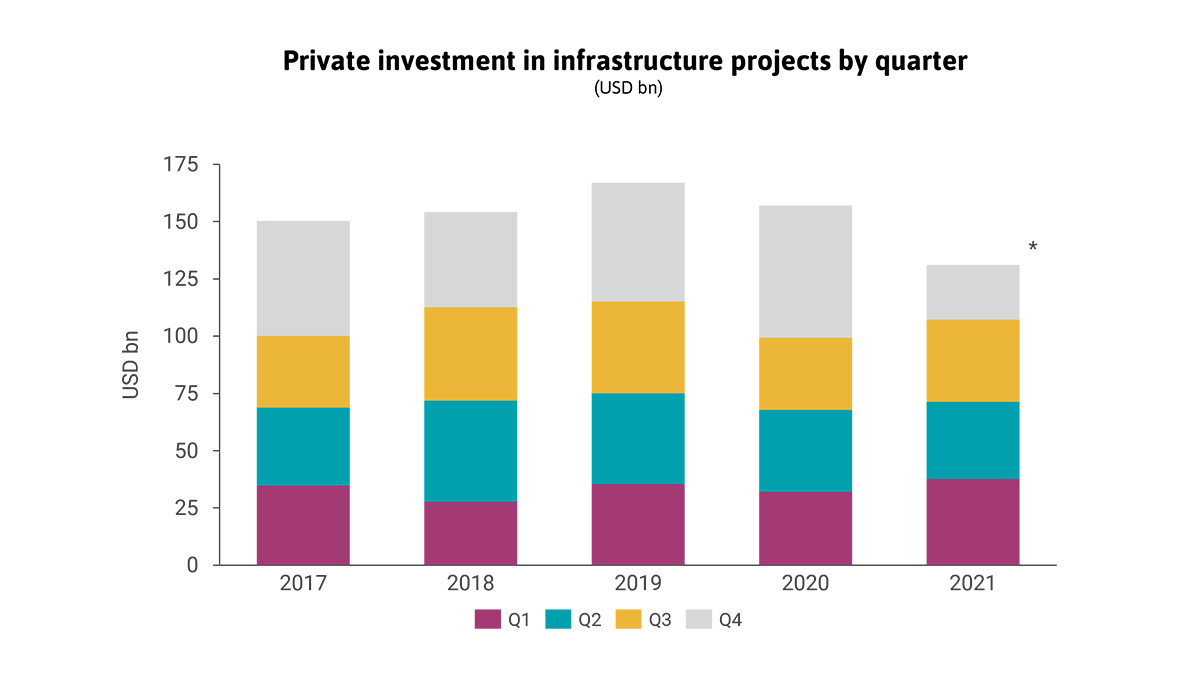

Private investment in infrastructure projects in primary markets has been stagnant for seven years running

Private investment in infrastructure projects in primary markets was resilient to COVID-19 pandemic shocks

Outlook forecasts infrastructure investment needed globally, nationally, and by sector so governments and industry can close the gap between need and planned investment.

This map summarizes information on the connectivity of 67 important South Asian cities concerning infrastructure networks.

Public investment in infrastructure is more effective in increasing economic output than other types of public spending

Investment in public transit infrastructure can contribute to creating more inclusive societies. Public transit services are more often used by lower-income households, women and ethnic minorities.

Regulatory capital frameworks require banks and insurers to put aside more capital for infrastructure investments than is warranted by their historical credit performance

Infrastructure equities have an attractive risk-return profile providing a competitive alternative to other investment options.

Merchant infrastructure, larger investors and the transport sector have experienced larger declines in returns due to COVID-19.

Infrastructure Monitor

Infrastructure Monitor