967 results found

Featured results

More results

The Belgrade Waste-to-Energy project is cleaning up one of Europe’s largest uncontrolled landfills and constructing a new, sustainable waste-management complex. It is one of the first large-scale, bankable, private sector waste-to-energy projects in emerging markets. Using a competitive dialogue with five pre-qualified bidders, the City of Belgrade - with the support of IFC acting as a PPP advisor - could offer a bankable DBFO contract bundling the remediation of the landfill (including the management of legacy pollution) with the development of revenue-generating greenfield assets.

The EBRD is contributing a ?128.25 million syndicated loan, including a loan of ?72.25 million for its own account, a loan of ?35 million provided by Erste Group Bank AG under the A/B loan structure, and ?21 million in concessional finance funded by Green Energy Special Fund.

The total project cost is EUR 980 million and includes upfront concession fee payment and four-year capex funding

Nicholas Yandle, Head of Programmes - Project Futures, UK IPA shares insights on their recent Roadmap, exploring ways to achieve digitalisation, standardised approaches and carbon emissions reductions when it comes to infrastructure delivery.

Improving the delivery of capital works and maintenance of water networks is essential to improving access to water and to do this, we need to rethink how we deliver infrastructure. Sydney Water has done just this with their Partnering for Success framework.

In 2018, the City of Nice in southern France signed a 25 year contract with IDEX to design, finance, realise, operate, and maintain a heating and cooling network as well as to implement a smart grid for energy efficiency. IDEX is implementing this project in the 500,000m2 Nice Meridia district, which is home to office space, retail, leisure, housing, schools, and a hospital.

We speak with the Colouring Cities Research Programme’s Polly Hudson on how open platforms for building attribute data will help to solve common urban challenges, and help increase the quality, sustainability, efficiency, and resilience of buildings.

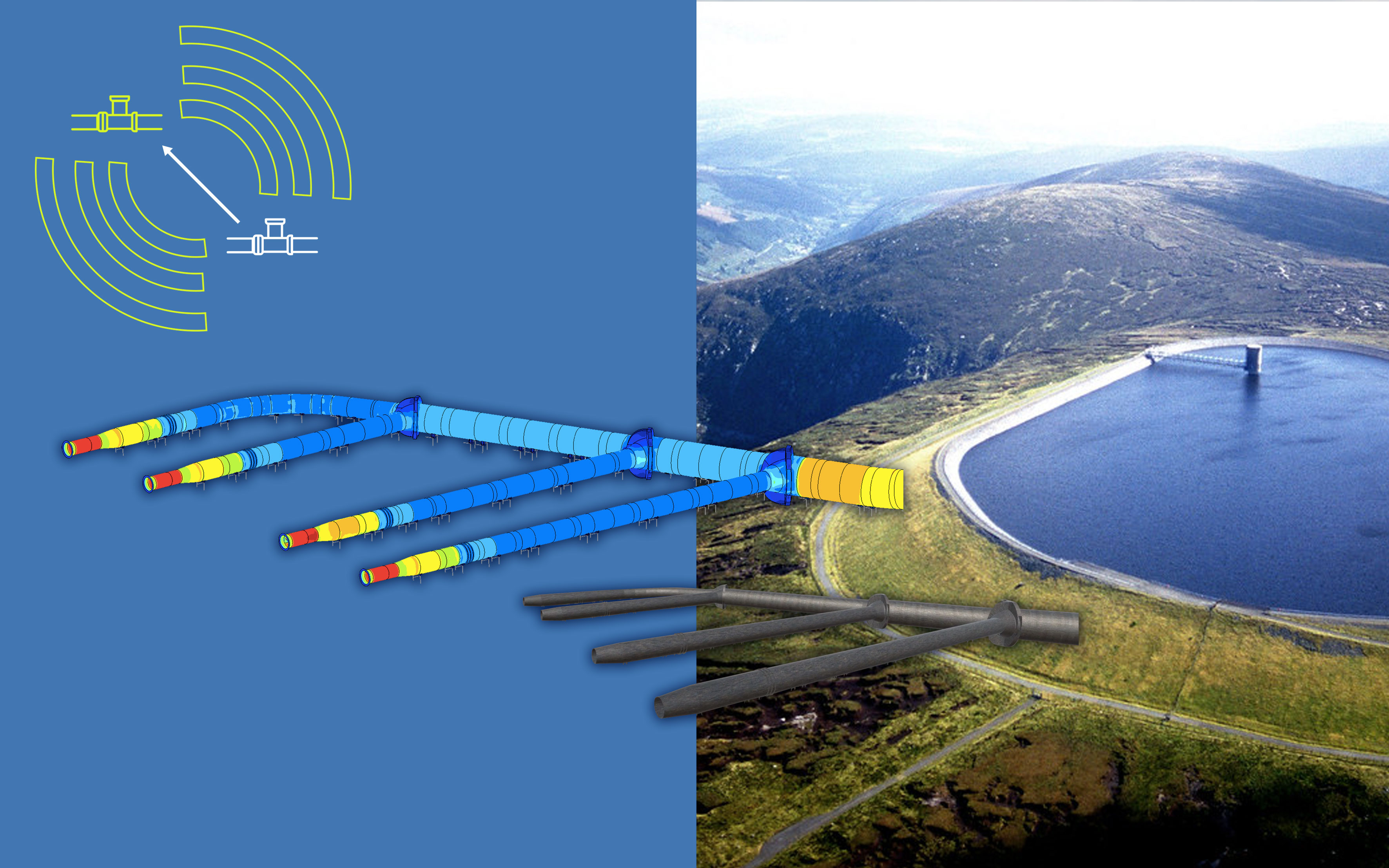

In 2019, Irish electricity company ESB was seeking a solution to help them understand the structural health of its 47-year-old Turlough Hill pumped storage station, which generates up to 292MW into the Irish grid during peak demand periods and – as Ireland’s only pumped storage station – has a crucial role in the country’s ongoing transition to renewable energy grid stabilisation.

Banks are leaders in structuring and financing private investment in new projects, however recent banking regulations discourage them from prioritising infrastructure

Drawing on current global developments, GI Hub CEO Marie Lam-Frendo offers five recommendations for how governments can act within the 4Ps of planning, policy, performance, and partnership to leverage infrastructure for economic and social outcomes, and to support the low-carbon transition.

Automated Robot Cranes (ARC) with Artificial Intelligence (AI) to perform tasks autonomously to avoid collisions, accidents and delays during operations.

Automated welding technologies used for pre-fabrication of pipes, tanks and treatment plants to reduce construction costs and project timeframes.

This week the Australian British Chamber of Commerce, the GI Hub and KPMG co-hosted an intimate infrastructure roundtable with the Lord Mayor of the City of London and senior Australian private sector participants, industry associations, think tanks, government, and infrastructure agencies.

Augmented Reality (AR) and Virtual Reality (VR) can be used to deploy training programs and assist workers in performing asset inspections and maintenance works.

This book questions the premise that Public-Private Partnerships (PPPs) have a performance advantage over traditionally procured projects. It examines novel research comparing the differences in performance between PPP and traditionally procured infrastructure projects and thoughtfully scrutinises the supposed advantages of PPPs.

Climate change poses a significant threat to infrastructure, with rising sea levels, extreme weather phenomena, and escalating temperatures posing substantial physical risks. These hazards can lead to the degradation of crucial infrastructure assets, undermining social, economic, and environmental stability. Recent analysis by EDHECInfra, as featured in the Global Infrastructure Hub's Infrastructure Monitor report, underscores the scale of the situation. Projections based on current climate and policy scenarios indicate that by 2050, infrastructure assets could see a net value decline of 4.4% on average, and up to 26.7% in the most severe scenarios. This depreciation is a direct consequence of the lack of resilience of global infrastructure to the effects of climate change. The consequences of inaction are far-reaching, affecting not just the financial performance of assets, but also the economic, environmental, and social fabric of communities worldwide. One promising strategy to mitigate these risks involves the adoption of a systemic resilience metrics (SRM) framework tailored specifically to infrastructure.

AsianInvestor interviews our CEO on the critical role of investors in promoting net-zero targets in infrastructure

Inflation continues to soar globally, the IMF forecasts inflation will rise from 4.7 percent in 2021 to 8.8 percent in 2022. In India, wholesale inflation has remained in double digits for more than a year. The IMF now expects global growth to slow from 6.0 percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023.

Improving Delivery Models

Improving Delivery Models