1740 results found

Featured results

More results

Over 70 participants from 13 countries met in Dakar, Senegal from 26-28 November 2019 to participate in a three-day infrastructure and PPP workshop, led by the Global Infrastructure Hub.

The CEI initiative drives understanding and adoption of circular infrastructure to reduce resource use and carbon emissions from infrastructure across its lifecycle.

A new GI Hub initiative, launching in November 2021, tracks the amount of infrastructure as a stimulus announced by G20 governments and presents data insights that will help governments, investors, multilateral development banks, and project directors achieve transformative outcomes from infrastructure in the post-COVID-19 recovery.

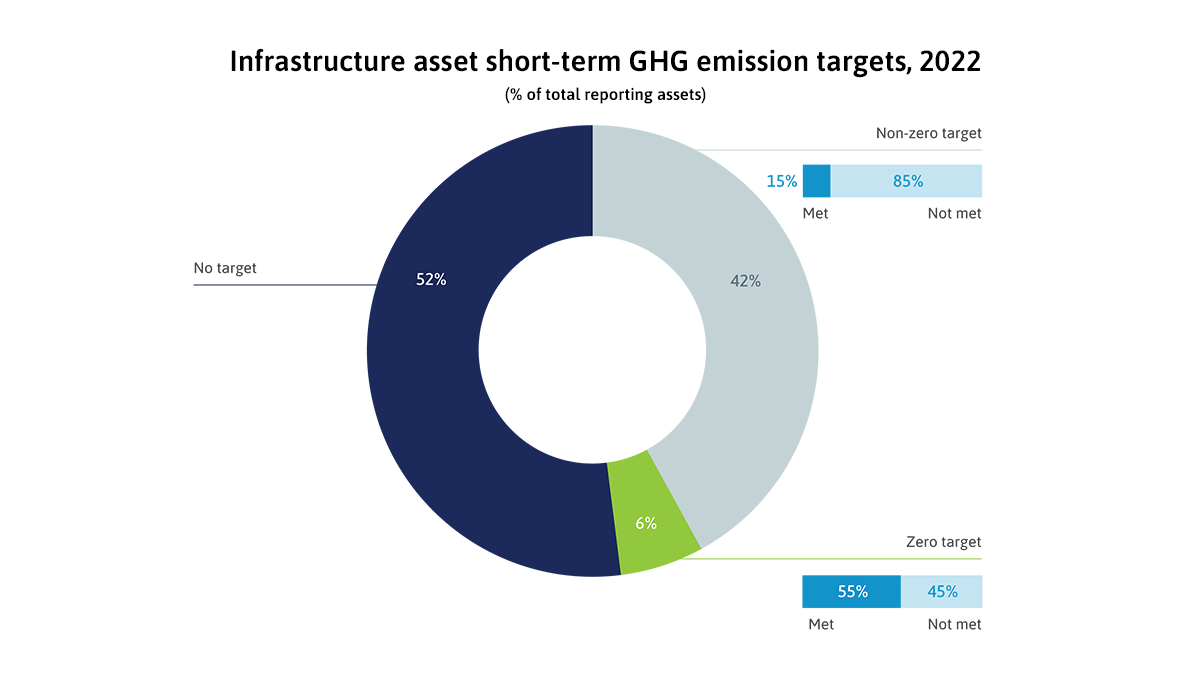

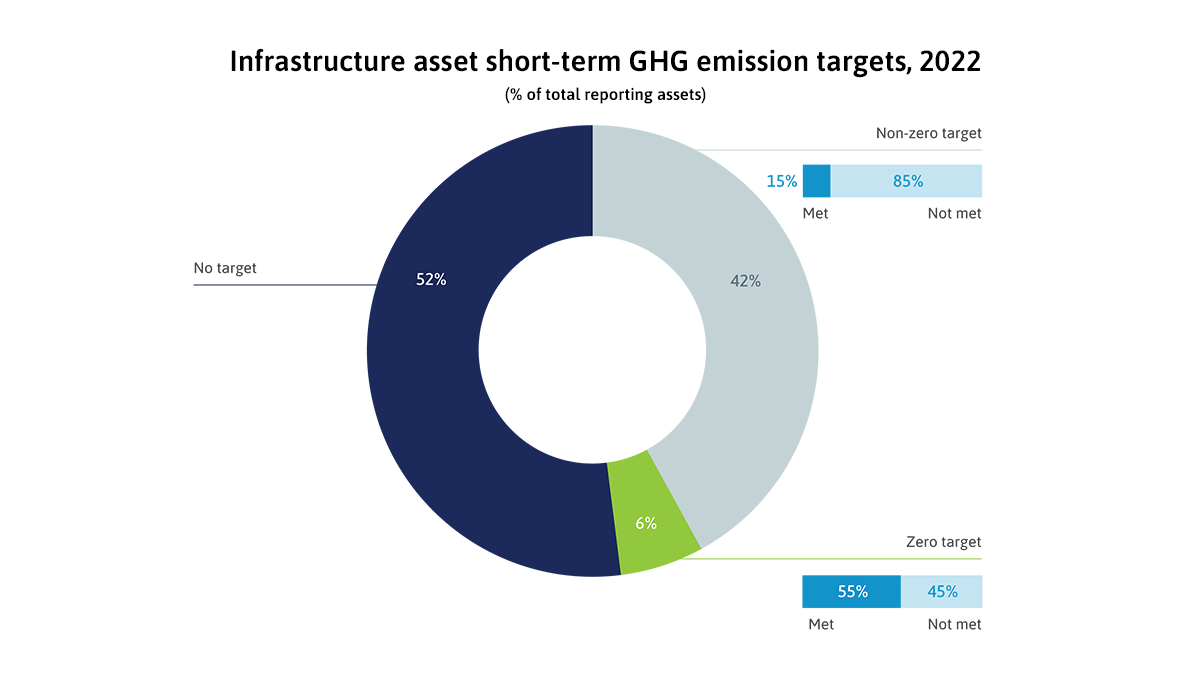

In 2022, infrastructure assets improved their ESG scores in all three pillars of ESG. The scores are encouraging, but they do not mean the assets themselves are more sustainable.

A new global survey of major international institutional investors has found strong investor demand for infrastructure, including record levels of interest in emerging market infrastructure with 37.5% of all investors now active in these growing markets.

The credit risk metrics for infrastructure debt improved during the COVID-19 pandemic, while those for non-infrastructure debt worsened. The performance of infrastructure loans demonstrates that infrastructure assets are resilient to adverse economic scenarios like pandemics.

Infrastructure debt has a highly attractive and resilient risk-return profile for investors. Expected losses are particularly low given high recovery rates in cases of default

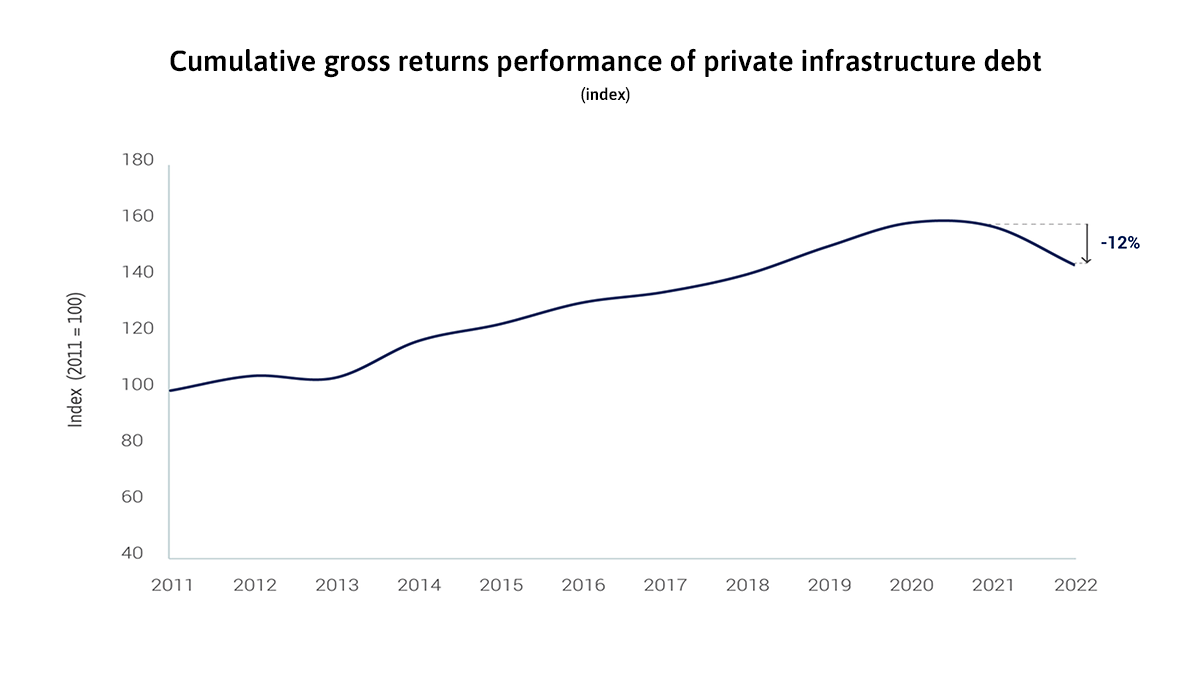

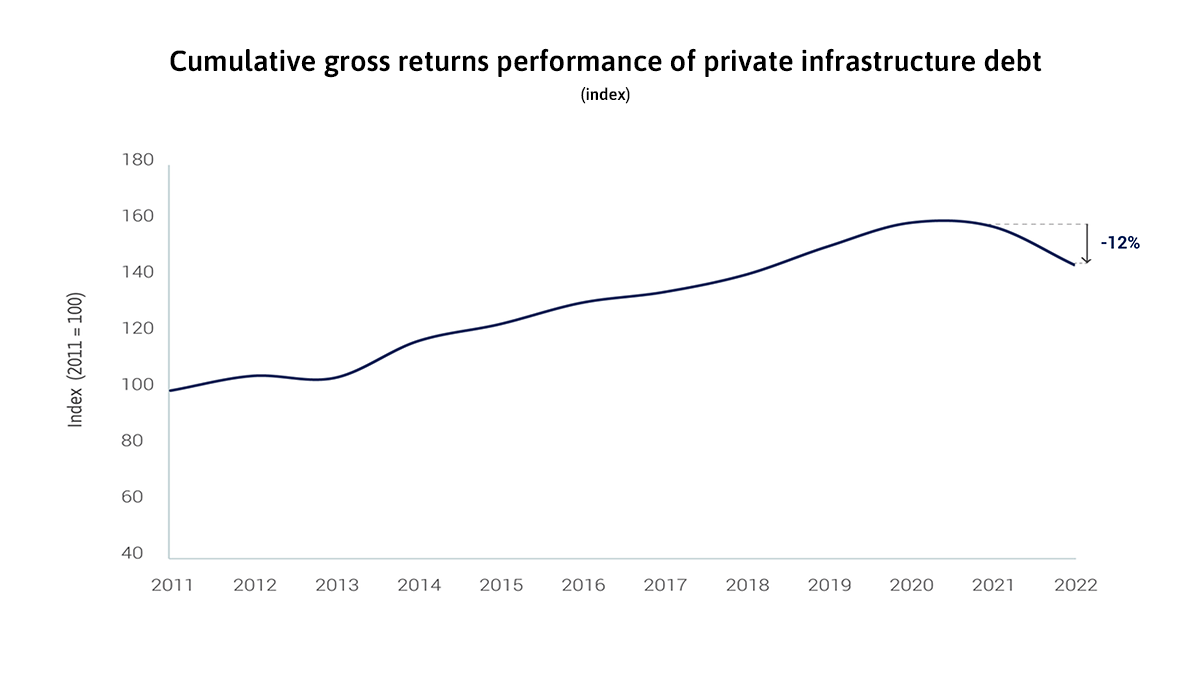

Rapid and sharp interest rate hikes in 2022 lowered the market value of existing infrastructure debt locked-in at the previous lower rates. Still, the attractiveness of infrastructure debt increased among private investors on account of its lower credit risk than corporate debt and increasing investors’ risk aversion

Kathrin Heitmann, CFA, Vice President - Senior Credit Officer, Global Infrastructure and Project Finance Group, Moody's Investors Service explores data-related findings that highlight how project and infrastructure debt continued to perform well during the COVID-19 pandemic.

Amidst rising interest rates and soaring inflation, infrastructure debt is an increasingly attractive investment strategy for private investors. Alex Murray, Vice President, Research Insights, Preqin explores this trend and what it means for infrastructure investments.

Social infrastructure is the best performing segment among all country income groupings, according to new data from Moody’s that provides insights into the debt performance for infrastructure industry sector. Social infrastructure includes healthcare, education and public (community housing, prisons) facilities. The data also reveals transport and energy infrastructure perform differently in relative terms for depending on country income grouping.

Although the topic of infrastructure may not attract bold headlines, the reality in many parts of the world is that the inadequate provision of critical infrastructure...

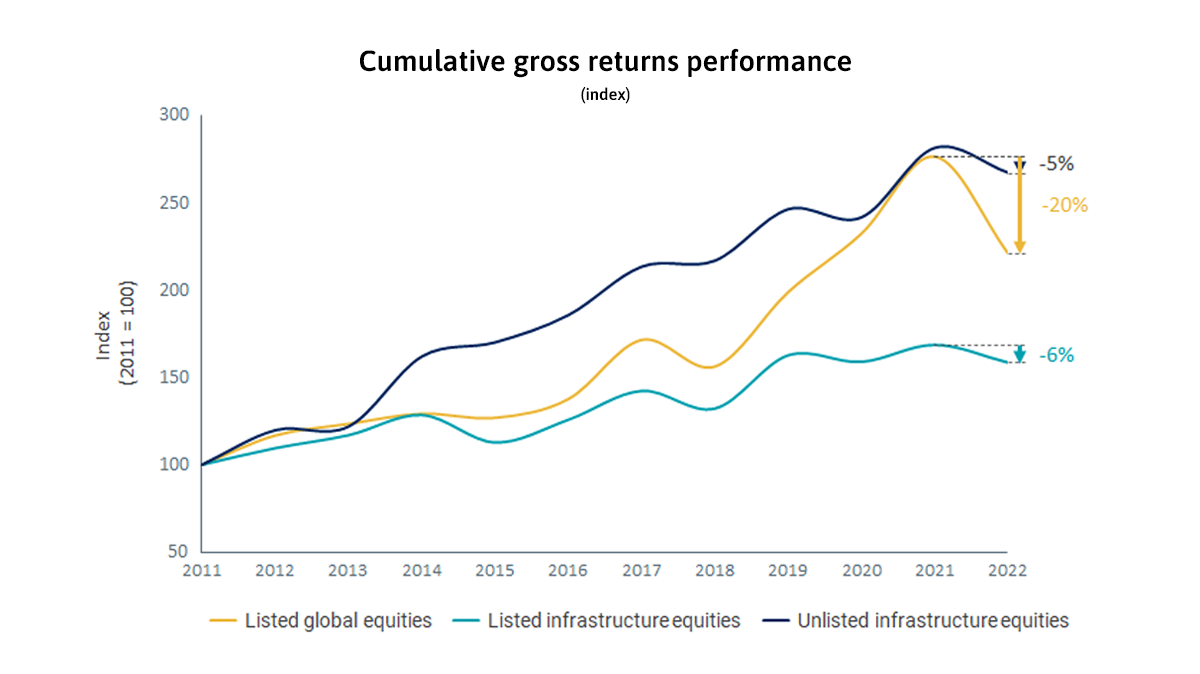

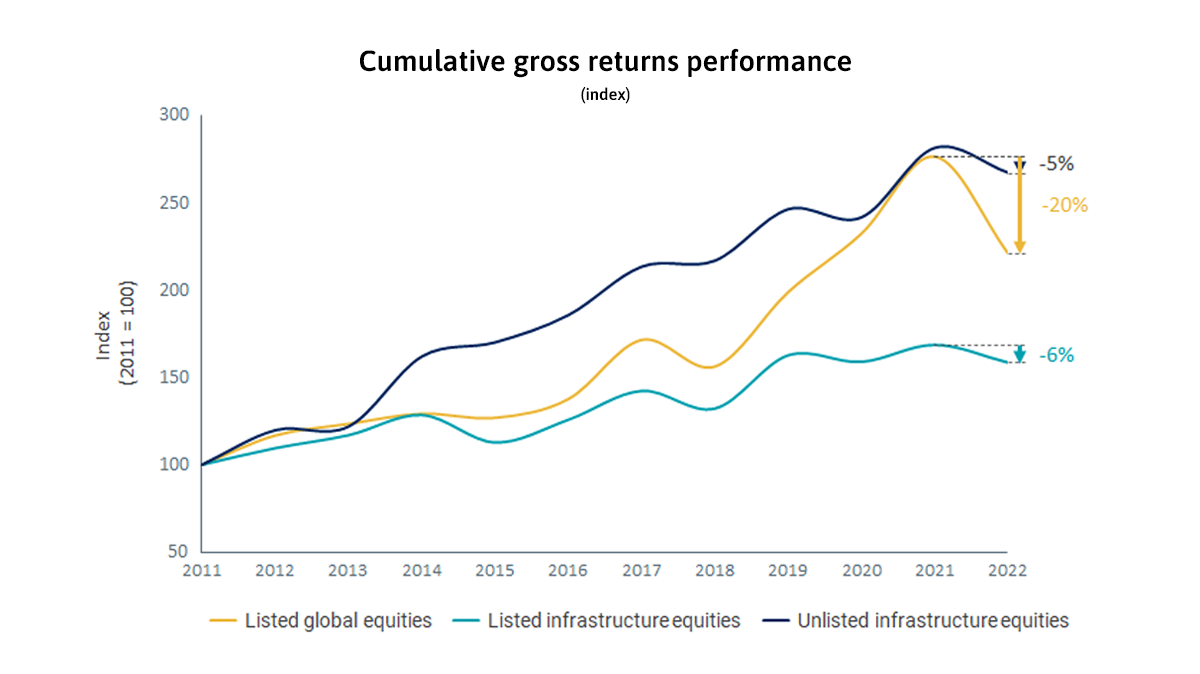

Infrastructure equities provide stronger protection against inflation shocks than the broader equity market. During the rapid inflation shocks in 2022, the return on infrastructure equities was more resilient than that on global equities, which drove private fundraising for infrastructure to record levels.

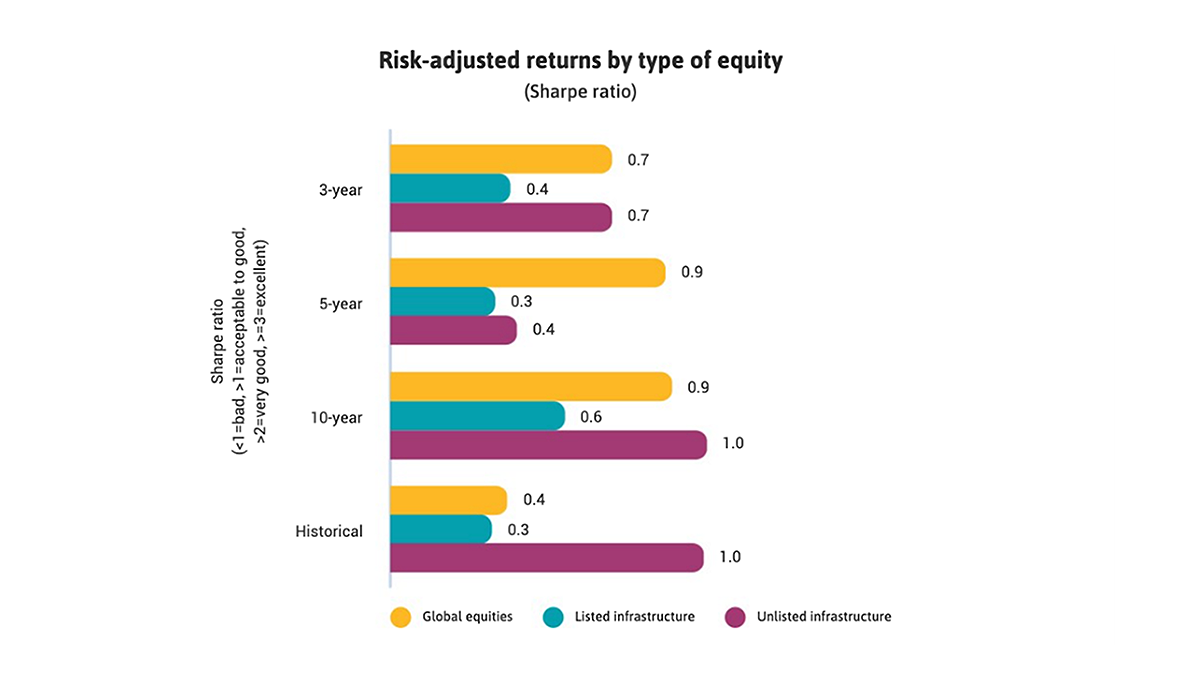

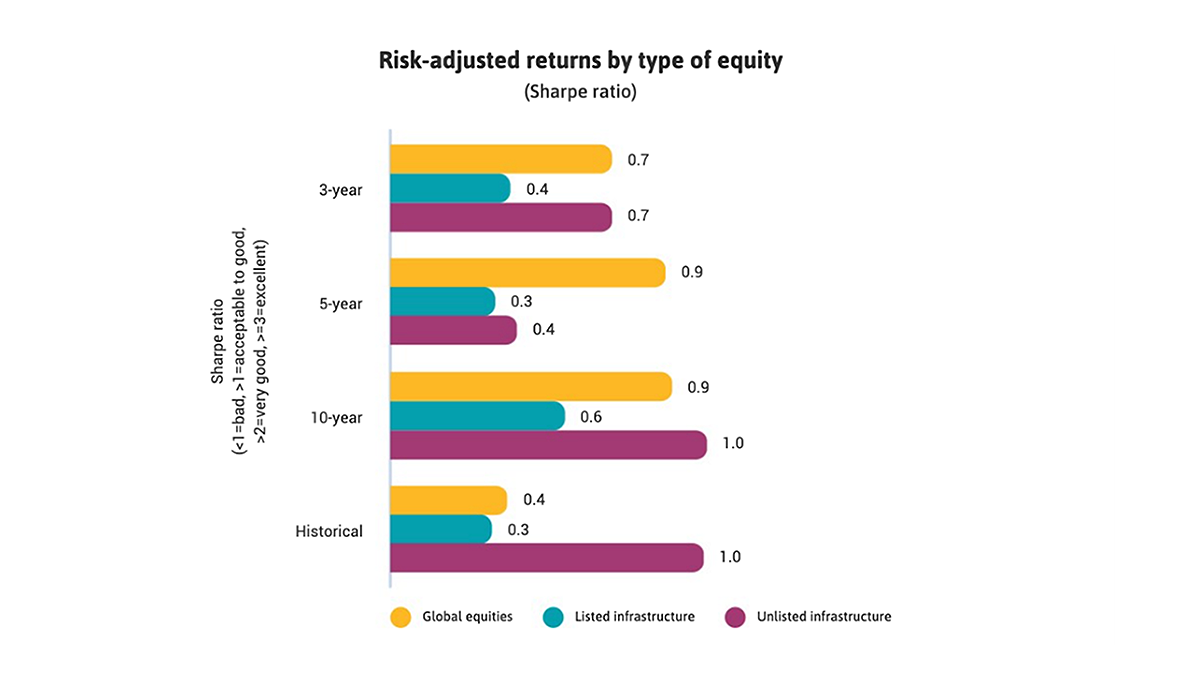

Infrastructure equities have an attractive risk-return profile providing a competitive alternative to other investment options.

Unlisted infrastructure equities have provided higher risk-adjusted returns to investors than an average global listed equity. With greater recognition of its attractive performance, investors’ demand has increased, and returns have aligned over time with its lower risk or volatility

This book discusses in detail the issues and challenges associated with infrastructure connectivity in Asia.

A series of methodologies and tools based on the evidence-based infrastructure (EBI) approach, helping governments assess and improve their capacity to plan, deliver and manage infrastructure systems.

PPP Risk Allocation Tool

PPP Risk Allocation Tool