922 results found

Featured results

More results

This brief analyzes the benefits and challenges of using portable screening devices to regulate medicine quality in low-income countries.

The study specifically examines whether power system size and coun¬try per capita income can be reliable indicators of initial conditions for guiding policy on power market structure.

Building Information Modelling (BIM) and pre-fabrication technology being used in conjunction to enable the project to be built virtually before construction, reducing issues or inefficiencies that can arise during the construction stage.

This report discusses findings from four case studies of the pre-investment stage in infrastructure projects in Latin America and the Caribbean.

Deloitte's Analytics Institute published this analysis of how new technology and data analytics can be used for predictive maintenance.

What does resilience to climate change look like and how can we support countries in coping with climate risks?

This handbook presents detailed, practical guidance on how to conduct quick, mid-level, and in-depth regulatory evaluations with focus on power sector regulation.

The OECD Principles for Public Governance of Public-Private Partnerships provide concrete guidance to policy makers on how to make sure that Public-Private Partnerships (PPP) represent value for money for the public sector.

The Infrastructure Prioritization Framework is a multi-criteria decision support tool that considers project outcomes along two dimensions, social-environmental and financial-economic to inform project selection.

This paper examines investments - in the form of equity or debt in direct investments to infrastructure. The reason for focusing on direct investment is twofold. First, the overall analysis of debt and equity capital markets for infrastructure exceeds the scope of this study and involves instruments that trade on regulated stock and bond markets. Second, the analysis of direct investments by private investors in listed infrastructure enables us to focus more on the risk analysis process that these investors typically perform when approaching an investment.

This report gives an overview of the main types of government and market based instruments and incentives able to boost the mobilisation of financial resources to long-term investment.

This report provides a comprehensive overview of digital transformation in Russia, including chapters on the general digital economy in Russia, the global best practice for enhancing digital platforms in Russa and boosting digital innovation.

This publication draws on the Private Sector Participation (PSP) experience of four emerging economies Brazil, Peru, the Philippines, and Turkey based on in-depth case studies by Energy Sector Management Assistance Program (ESMAP).

It addresses the growing worldwide interest in the use of light rail metro transit (LRMT) schemes to provide urban transport solutions and reviews the potential use of public-private partnership (PPP).

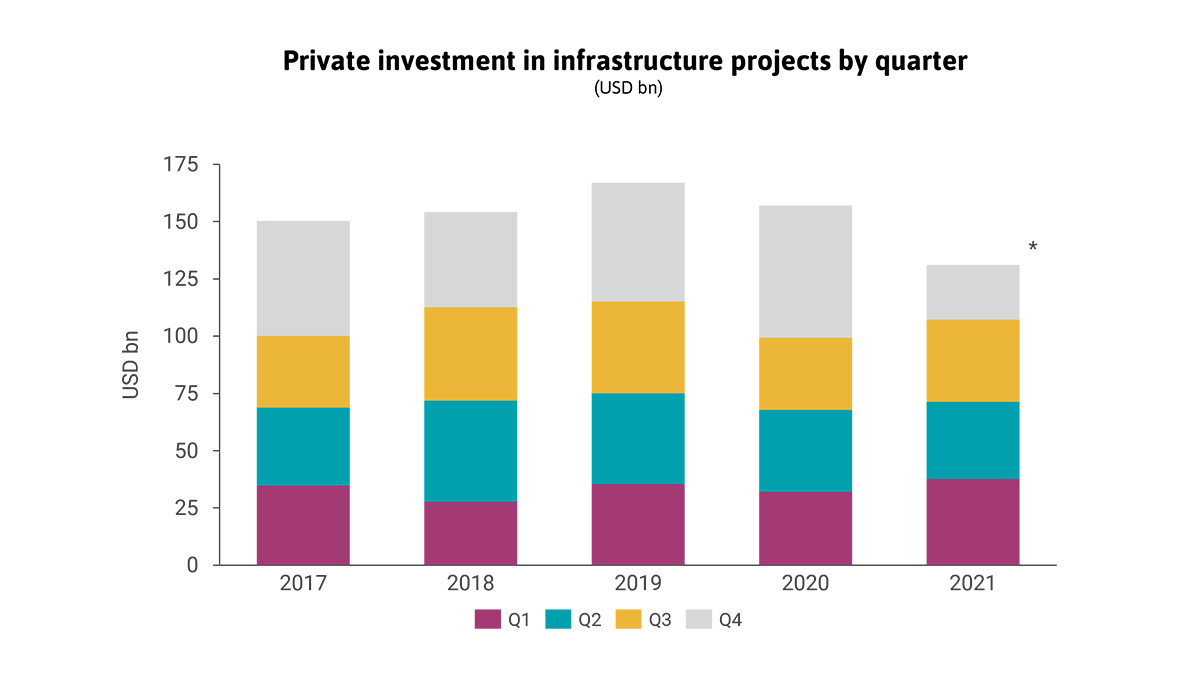

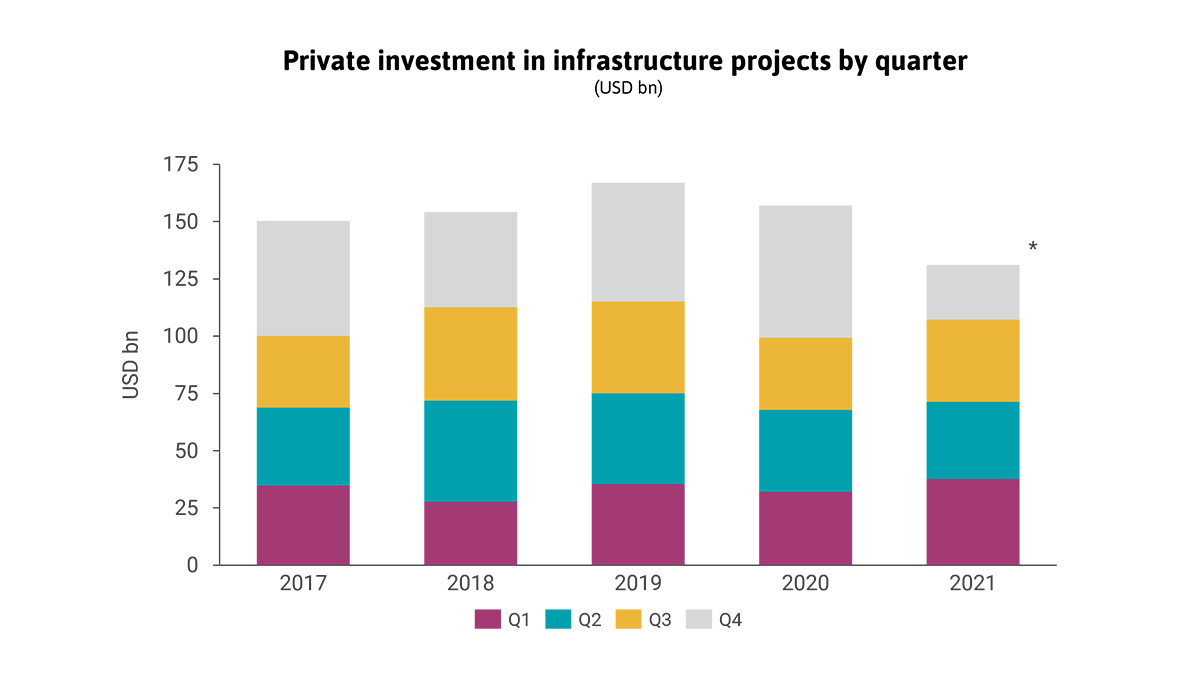

In 2021, private investment in infrastructure projects in primary markets recovered to its pre-pandemic level but remains stagnant and far shy of what is needed to close the infrastructure investment gap.

Private investment in infrastructure projects in primary markets was resilient to COVID-19 pandemic shocks

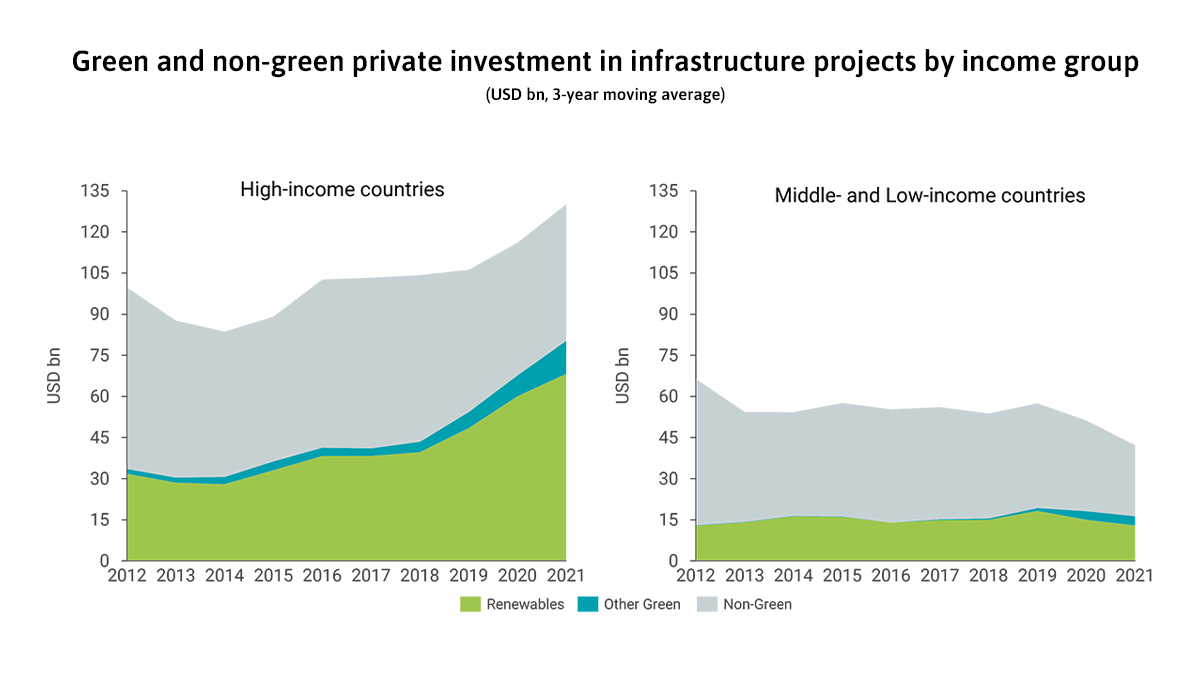

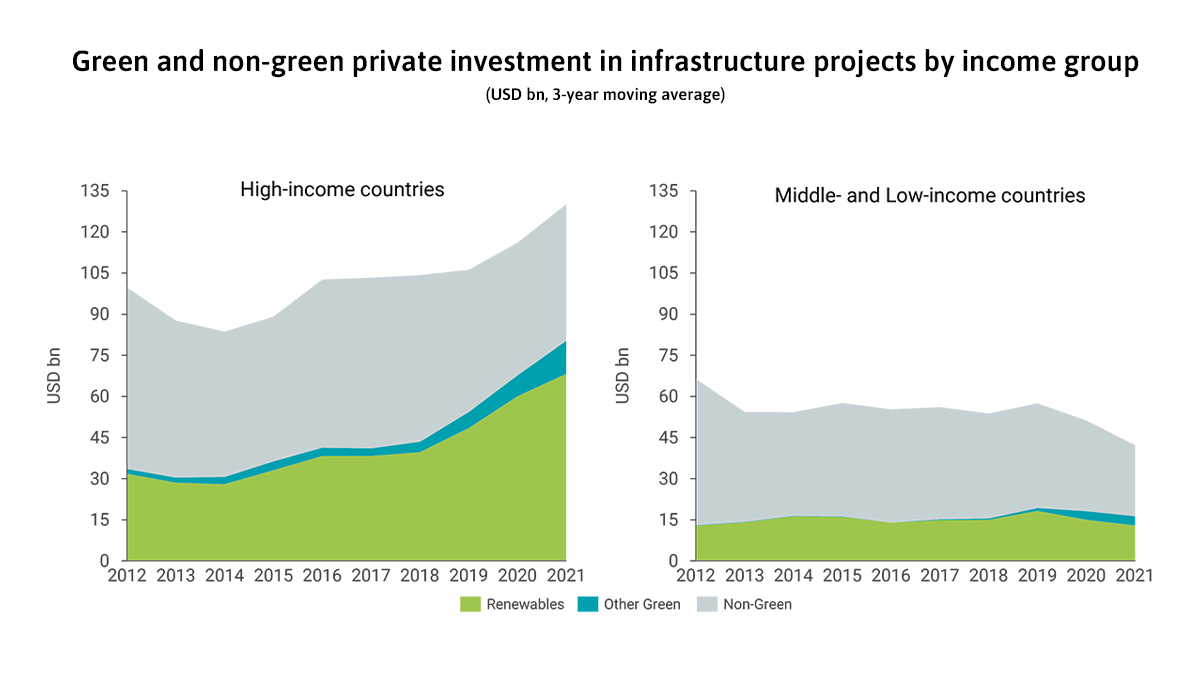

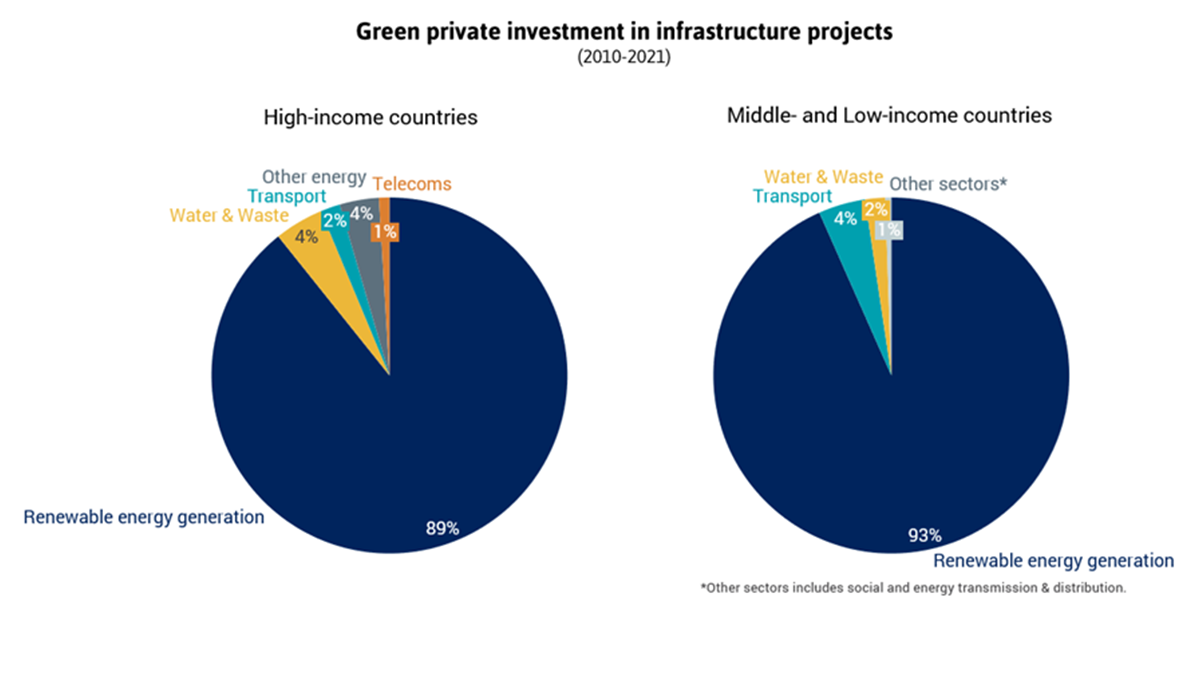

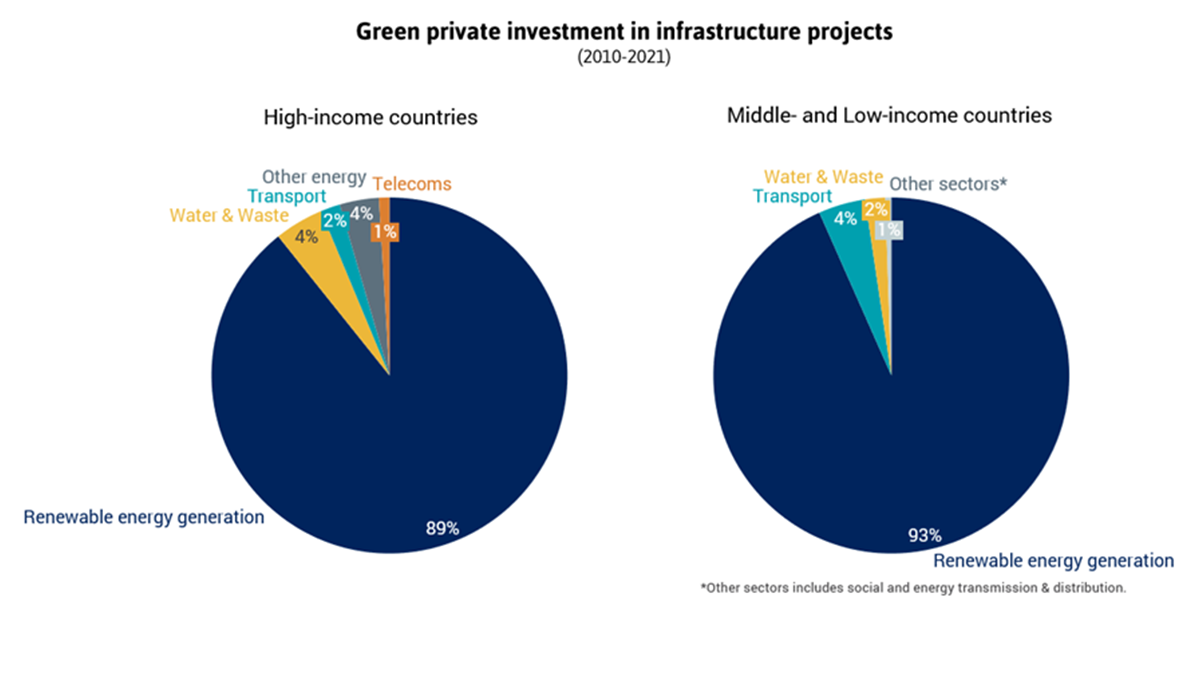

In 2021, global green private investment in infrastructure projects in primary markets rose to a record-high share of 60%, but this trend needs to accelerate and expand beyond renewables to meet climate goals.

Green investment in infrastructure outside of renewables is limited. While renewables represent almost 90% of total green private investments in infrastructure projects, green investment in other sectors only represent 14%.

Cities are at the forefront of the pandemic crisis and are key players in the fight to achieve net-zero emissions targets. The recovery choices they make today will set urban agendas for years to come.

Infrastructure Monitor

Infrastructure Monitor